Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ 2018 losses in Facebook and Apple. Let’s take a closer look at what the funds we track think about Enel Chile S.A. (NYSE:ENIC) in this article.

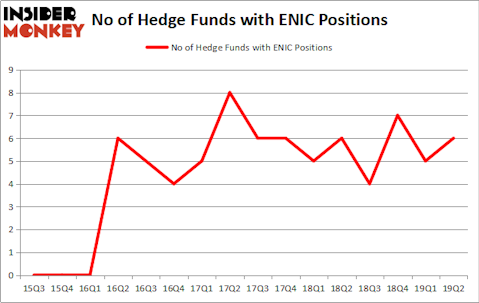

Is Enel Chile S.A. (NYSE:ENIC) the right investment to pursue these days? Money managers are in an optimistic mood. The number of bullish hedge fund positions rose by 1 in recent months. Our calculations also showed that ENIC isn’t among the 30 most popular stocks among hedge funds (see the video below). ENIC was in 6 hedge funds’ portfolios at the end of the second quarter of 2019. There were 5 hedge funds in our database with ENIC holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are a large number of indicators stock traders employ to evaluate stocks. A pair of the most underrated indicators are hedge fund and insider trading sentiment. We have shown that, historically, those who follow the top picks of the best hedge fund managers can beat the market by a superb amount (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the recent hedge fund action encompassing Enel Chile S.A. (NYSE:ENIC).

Hedge fund activity in Enel Chile S.A. (NYSE:ENIC)

At the end of the second quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in ENIC over the last 16 quarters. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’s AQR Capital Management has the largest position in Enel Chile S.A. (NYSE:ENIC), worth close to $8.1 million, corresponding to less than 0.1%% of its total 13F portfolio. Coming in second is Renaissance Technologies, with a $6.7 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers that are bullish encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Israel Englander’s Millennium Management and D. E. Shaw’s D E Shaw.

As one would reasonably expect, some big names have been driving this bullishness. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most outsized position in Enel Chile S.A. (NYSE:ENIC). Marshall Wace LLP had $0.6 million invested in the company at the end of the quarter.

Let’s also examine hedge fund activity in other stocks similar to Enel Chile S.A. (NYSE:ENIC). These stocks are New Residential Investment Corp (NYSE:NRZ), Reliance Steel & Aluminum Co. (NYSE:RS), Starwood Property Trust, Inc. (NYSE:STWD), and Companhia Brasileira de Distrib. (NYSE:CBD). All of these stocks’ market caps match ENIC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NRZ | 16 | 155738 | -2 |

| RS | 19 | 287950 | -4 |

| STWD | 14 | 136432 | -1 |

| CBD | 11 | 62442 | -1 |

| Average | 15 | 160641 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $161 million. That figure was $29 million in ENIC’s case. Reliance Steel & Aluminum Co. (NYSE:RS) is the most popular stock in this table. On the other hand Companhia Brasileira de Distrib. (NYSE:CBD) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks Enel Chile S.A. (NYSE:ENIC) is even less popular than CBD. Hedge funds dodged a bullet by taking a bearish stance towards ENIC. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately ENIC wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); ENIC investors were disappointed as the stock returned -11.9% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.