Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. In this article we are going to take a look at smart money sentiment towards CenturyLink, Inc. (NYSE:CTL).

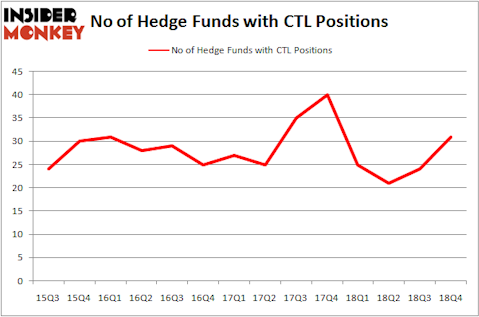

Is CenturyLink, Inc. (NYSE:CTL) a healthy stock for your portfolio? Money managers are starting to get bullish. The number of long hedge fund positions inched up by 7 in recent months. Our calculations also showed that CTL isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are plenty of indicators stock market investors can use to evaluate their stock investments. Two of the best indicators are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outperform the broader indices by a significant margin (see the details here).

Let’s take a glance at the fresh hedge fund action surrounding CenturyLink, Inc. (NYSE:CTL).

Hedge fund activity in CenturyLink, Inc. (NYSE:CTL)

Heading into the first quarter of 2019, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 29% from the second quarter of 2018. By comparison, 25 hedge funds held shares or bullish call options in CTL a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Southeastern Asset Management, managed by Mason Hawkins, holds the biggest position in CenturyLink, Inc. (NYSE:CTL). Southeastern Asset Management has a $975 million position in the stock, comprising 13.9% of its 13F portfolio. The second most bullish fund manager is Millennium Management, managed by Israel Englander, which holds a $87.3 million position; 0.1% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism comprise Ken Griffin’s Citadel Investment Group, Prem Watsa’s Fairfax Financial Holdings and Joel Greenblatt’s Gotham Asset Management.

As one would reasonably expect, key hedge funds have jumped into CenturyLink, Inc. (NYSE:CTL) headfirst. Garelick Capital Partners, managed by Bruce Garelick, assembled the most valuable position in CenturyLink, Inc. (NYSE:CTL). Garelick Capital Partners had $12.9 million invested in the company at the end of the quarter. Jim Simons’s Renaissance Technologies also initiated a $8.6 million position during the quarter. The other funds with new positions in the stock are Joseph Samuels’s Islet Management, Paul Marshall and Ian Wace’s Marshall Wace LLP, and Cliff Asness’s AQR Capital Management.

Let’s now review hedge fund activity in other stocks similar to CenturyLink, Inc. (NYSE:CTL). We will take a look at CBS Corporation (NYSE:CBS), International Paper Company (NYSE:IP), Smith & Nephew plc (NYSE:SNN), and Check Point Software Technologies Ltd. (NASDAQ:CHKP). This group of stocks’ market caps match CTL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBS | 45 | 903498 | 0 |

| IP | 34 | 435169 | 6 |

| SNN | 11 | 368173 | 2 |

| CHKP | 26 | 727516 | 0 |

| Average | 29 | 608589 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $609 million. That figure was $1253 million in CTL’s case. CBS Corporation (NYSE:CBS) is the most popular stock in this table. On the other hand Smith & Nephew plc (NYSE:SNN) is the least popular one with only 11 bullish hedge fund positions. CenturyLink, Inc. (NYSE:CTL) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately CTL wasn’t in this group. Hedge funds that bet on CTL were disappointed as the stock lost 18.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.