A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by 4 percentage points during the first half of the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of Century Aluminum Co (NASDAQ:CENX) during the quarter.

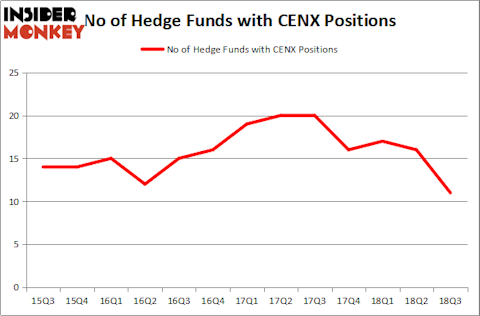

Is Century Aluminum Co (NASDAQ:CENX) an exceptional investment now? Hedge funds are reducing their bets on the stock. The number of long hedge fund bets went down by 5 recently. Our calculations also showed that CENX isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s go over the key hedge fund action regarding Century Aluminum Co (NASDAQ:CENX).

What does the smart money think about Century Aluminum Co (NASDAQ:CENX)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -31% from the previous quarter. On the other hand, there were a total of 16 hedge funds with a bullish position in CENX at the beginning of this year. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Dmitry Balyasny’s Balyasny Asset Management has the number one position in Century Aluminum Co (NASDAQ:CENX), worth close to $23.6 million, comprising 0.1% of its total 13F portfolio. The second largest stake is held by Fisher Asset Management, managed by Ken Fisher, which holds a $16.4 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other peers that are bullish encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Ken Griffin’s Citadel Investment Group and Cliff Asness’s AQR Capital Management.

Because Century Aluminum Co (NASDAQ:CENX) has witnessed a decline in interest from the aggregate hedge fund industry, logic holds that there was a specific group of money managers that decided to sell off their entire stakes by the end of the third quarter. At the top of the heap, Michael Platt and William Reeves’s BlueCrest Capital Mgmt. dumped the largest stake of the “upper crust” of funds monitored by Insider Monkey, valued at about $6 million in stock. Israel Englander’s fund, Millennium Management, also sold off its stock, about $5.8 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest dropped by 5 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Century Aluminum Co (NASDAQ:CENX) but similarly valued. These stocks are COMSCORE, Inc. (NASDAQ:SCOR), eXp World Holdings, Inc. (NASDAQ:EXPI), Loma Negra Compania Industrial Argentina Sociedad Anonima (NYSE:LOMA), and SSR Mining Inc. (NASDAQ:SSRM). This group of stocks’ market valuations match CENX’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCOR | 13 | 248673 | -2 |

| EXPI | 5 | 1449 | 3 |

| LOMA | 11 | 19866 | -1 |

| SSRM | 8 | 87909 | 0 |

| Average | 9.25 | 89474 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $89 million. That figure was $71 million in CENX’s case. COMSCORE, Inc. (NASDAQ:SCOR) is the most popular stock in this table. On the other hand eXp World Holdings, Inc. (NASDAQ:EXPI) is the least popular one with only 5 bullish hedge fund positions. Century Aluminum Co (NASDAQ:CENX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SCOR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.