We know that hedge funds generate strong, risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Peltz’s recent General Electric losses). However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Bristol Myers Squibb Company (NYSE:BMY).

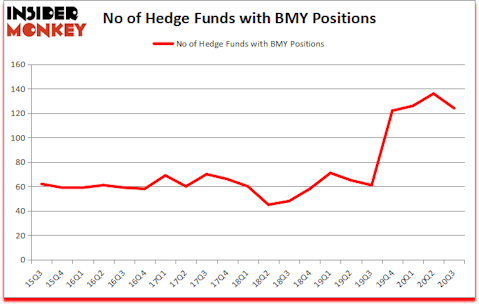

Bristol Myers Squibb Company (NYSE:BMY) shareholders have witnessed a decrease in hedge fund interest lately even though Warren Buffett’s Berkshire disclosed a $$1.8 billion position in the stock in its 13F filing. Bristol Myers Squibb Company (NYSE:BMY) was in 124 hedge funds’ portfolios at the end of September. The all time high for this statistics is 136. Our calculations also showed that BMY ranks 11th among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of formulas shareholders have at their disposal to evaluate publicly traded companies. A pair of the less known formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can trounce their index-focused peers by a healthy amount (see the details here).

Andreas Halvorsen of Viking Global

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, we believe electric vehicles and energy storage are set to become giant markets. Tesla’s stock price skyrocketed, yet lithium prices are still below their 2019 highs. So, we are checking out this lithium stock right now. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. Now let’s go over the new hedge fund action surrounding Bristol Myers Squibb Company (NYSE:BMY).

What have hedge funds been doing with Bristol Myers Squibb Company (NYSE:BMY)?

Heading into the fourth quarter of 2020, a total of 124 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the second quarter of 2020. The graph below displays the number of hedge funds with bullish position in BMY over the last 21 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Bristol Myers Squibb Company (NYSE:BMY), which was worth $1843.5 million at the end of the third quarter. On the second spot was Berkshire Hathaway which amassed $1807 million worth of shares. Citadel Investment Group, Two Sigma Advisors, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Birchview Capital allocated the biggest weight to Bristol Myers Squibb Company (NYSE:BMY), around 32% of its 13F portfolio. Copernicus Capital Management is also relatively very bullish on the stock, earmarking 12.25 percent of its 13F equity portfolio to BMY.

Seeing as Bristol Myers Squibb Company (NYSE:BMY) has experienced declining sentiment from hedge fund managers, it’s easy to see that there was a specific group of fund managers who were dropping their full holdings heading into Q44. At the top of the heap, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital said goodbye to the biggest stake of the 750 funds followed by Insider Monkey, valued at close to $64.2 million in stock. Doron Breen and Mori Arkin’s fund, Sphera Global Healthcare Fund, also said goodbye to its stock, about $41.2 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 12 funds heading into Q44.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Bristol Myers Squibb Company (NYSE:BMY) but similarly valued. We will take a look at Chevron Corporation (NYSE:CVX), Zoom Video Communications, Inc. (NASDAQ:ZM), Union Pacific Corporation (NYSE:UNP), QUALCOMM, Incorporated (NASDAQ:QCOM), China Mobile Limited (NYSE:CHL), Texas Instruments Incorporated (NASDAQ:TXN), and BHP Group (NYSE:BHP). This group of stocks’ market values match BMY’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVX | 43 | 1247481 | -7 |

| ZM | 56 | 9721272 | 8 |

| UNP | 74 | 3916765 | 6 |

| QCOM | 87 | 2581329 | 13 |

| CHL | 10 | 400662 | 1 |

| TXN | 55 | 2079422 | 0 |

| BHP | 18 | 710662 | 2 |

| Average | 49 | 2951085 | 3.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49 hedge funds with bullish positions and the average amount invested in these stocks was $2951 million. That figure was $7567 million in BMY’s case. QUALCOMM, Incorporated (NASDAQ:QCOM) is the most popular stock in this table. On the other hand China Mobile Limited (NYSE:CHL) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Bristol Myers Squibb Company (NYSE:BMY) is more popular among hedge funds. Our overall hedge fund sentiment score for BMY is 92.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10 percentage points. These stocks gained 28.1% in 2020 through November 23rd and still beat the market by 15.4 percentage points. Unfortunately BMY wasn’t nearly as successful as these 20 stocks and hedge funds that were betting on BMY were disappointed as the stock returned 3.5% since the end of the third quarter (through 11/23) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the more diversified list of the top 20 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Bristol Myers Squibb Co (NYSE:BMY)

Follow Bristol Myers Squibb Co (NYSE:BMY)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.