A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Bright Horizons Family Solutions Inc (NYSE:BFAM).

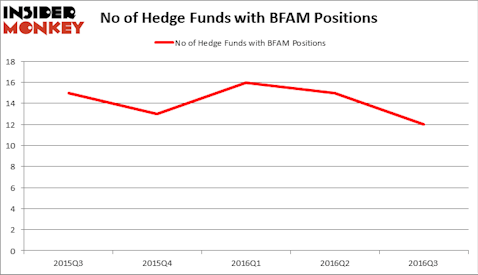

Is Bright Horizons Family Solutions Inc (NYSE:BFAM) the right investment to pursue these days? The smart money is indeed getting less bullish. The number of bullish hedge fund bets slashed by 3 lately. There were 12 hedge funds in our database with BFAM holdings at the end of the last quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Hudson Pacific Properties Inc (NYSE:HPP), Fibria Celulose SA (ADR) (NYSE:FBR), and Cypress Semiconductor Corporation (NASDAQ:CY) to gather more data points.

Follow Bright Horizons Family Solutions Inc. (NYSE:BFAM)

Follow Bright Horizons Family Solutions Inc. (NYSE:BFAM)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Poznyakov/Shutterstock.com

How have hedgies been trading Bright Horizons Family Solutions Inc (NYSE:BFAM)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, down by 20% from the second quarter of 2016. On the other hand, there were a total of 13 hedge funds with a bullish position in BFAM at the beginning of this year. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Robert Joseph Caruso’s Select Equity Group has the number one position in Bright Horizons Family Solutions Inc (NYSE:BFAM), worth close to $35.8 million. Coming in second is ShearLink Capital, led by Vivek Mehta and Aaron Husock, which holds a $10.9 million position; the fund has 3.5% of its 13F portfolio invested in the stock. Remaining peers that are bullish include Renaissance Technologies, one of the largest hedge funds in the world, Leighton Welch’s Welch Capital Partners and John Ku’s Manor Road Capital Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually sold off their positions entirely. At the top of the heap, Phill Gross and Robert Atchinson’s Adage Capital Management sold off the biggest position of the “upper crust” of funds monitored by Insider Monkey, totaling an estimated $9.9 million in stock. Richard Chilton’s fund, Chilton Investment Company, also said goodbye to its stock, about $4.4 million worth.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Bright Horizons Family Solutions Inc (NYSE:BFAM) but similarly valued. We will take a look at Hudson Pacific Properties Inc (NYSE:HPP), Fibria Celulose SA (ADR) (NYSE:FBR), Cypress Semiconductor Corporation (NASDAQ:CY), and Transocean LTD (NYSE:RIG). All of these stocks’ market caps match BFAM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HPP | 17 | 189409 | -6 |

| FBR | 7 | 39986 | -4 |

| CY | 31 | 366691 | 6 |

| RIG | 35 | 457059 | 3 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $263 million. That figure was $87 million in BFAM’s case. Transocean LTD (NYSE:RIG) is the most popular stock in this table. On the other hand Fibria Celulose SA (ADR) (NYSE:FBR) is the least popular one with only 7 bullish hedge fund positions. Bright Horizons Family Solutions Inc (NYSE:BFAM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard RIG might be a better candidate to consider taking a long position in.

Disclosure: None