Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 of 2018 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETFs by nearly 10 percentage points during the first 11 months of 2019. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Big 5 Sporting Goods Corporation (NASDAQ:BGFV) from the perspective of those elite funds.

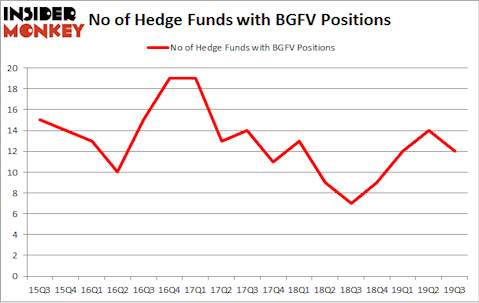

Big 5 Sporting Goods Corporation (NASDAQ:BGFV) shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that BGFV isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are viewed as slow, outdated financial vehicles of years past. While there are greater than 8000 funds with their doors open at the moment, Our experts choose to focus on the moguls of this group, approximately 750 funds. These investment experts administer most of the smart money’s total capital, and by watching their first-class stock picks, Insider Monkey has found a number of investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Paul Marshall of Marshall Wace

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the key hedge fund action regarding Big 5 Sporting Goods Corporation (NASDAQ:BGFV).

Hedge fund activity in Big 5 Sporting Goods Corporation (NASDAQ:BGFV)

Heading into the fourth quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards BGFV over the last 17 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Firefly Value Partners held the most valuable stake in Big 5 Sporting Goods Corporation (NASDAQ:BGFV), which was worth $2.1 million at the end of the third quarter. On the second spot was Millennium Management which amassed $0.6 million worth of shares. Cove Street Capital, D E Shaw, and Marshall Wace were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Firefly Value Partners allocated the biggest weight to Big 5 Sporting Goods Corporation (NASDAQ:BGFV), around 0.32% of its 13F portfolio. Cove Street Capital is also relatively very bullish on the stock, dishing out 0.09 percent of its 13F equity portfolio to BGFV.

Seeing as Big 5 Sporting Goods Corporation (NASDAQ:BGFV) has witnessed falling interest from the aggregate hedge fund industry, it’s easy to see that there is a sect of money managers who were dropping their entire stakes last quarter. Intriguingly, Donald Sussman’s Paloma Partners cut the largest position of all the hedgies followed by Insider Monkey, valued at an estimated $0.2 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund said goodbye to about $0.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 2 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to Big 5 Sporting Goods Corporation (NASDAQ:BGFV). These stocks are Aclaris Therapeutics, Inc. (NASDAQ:ACRS), BBQ Holdings, Inc. (NASDAQ:BBQ), ICC Holdings, Inc. (NASDAQ:ICCH), and Pintec Technology Holdings Limited (NASDAQ:PT). This group of stocks’ market caps match BGFV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACRS | 15 | 19036 | 1 |

| BBQ | 4 | 18207 | 4 |

| ICCH | 3 | 1303 | 0 |

| PT | 1 | 17 | 0 |

| Average | 5.75 | 9641 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.75 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $6 million in BGFV’s case. Aclaris Therapeutics, Inc. (NASDAQ:ACRS) is the most popular stock in this table. On the other hand Pintec Technology Holdings Limited (NASDAQ:PT) is the least popular one with only 1 bullish hedge fund positions. Big 5 Sporting Goods Corporation (NASDAQ:BGFV) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on BGFV as the stock returned 32.2% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.