After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the successful hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Atmos Energy Corporation (NYSE:ATO).

Atmos Energy Corporation (NYSE:ATO) has seen a decrease in support from the world’s most successful money managers of late. There were 13 hedge funds in our database with ATO holdings at the end of the second quarter. At the end of this article we will also compare ATO to other stocks including Philippine Long Distance Telephone (ADR) (NYSE:PHI), Vedanta Ltd (ADR) (NYSE:VEDL), and Dr. Reddy’s Laboratories Limited (ADR) (NYSE:RDY) to get a better sense of its popularity.

Follow Atmos Energy Corp (NYSE:ATO)

Follow Atmos Energy Corp (NYSE:ATO)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Zorandim/Shutterstock.com

Now, we’re going to review the recent action surrounding Atmos Energy Corporation (NYSE:ATO).

How have hedgies been trading Atmos Energy Corporation (NYSE:ATO)?

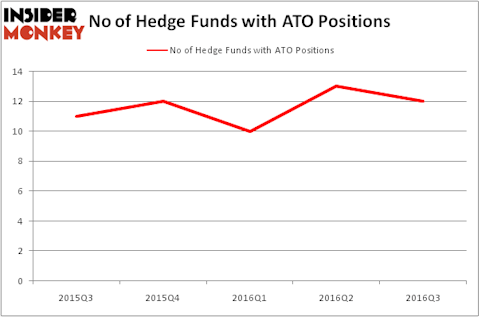

Heading into the fourth quarter of 2016, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 8% from the second quarter of 2016. Below, you can check out the change in hedge fund sentiment towards ATO over the last 5 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Millennium Management, one of the 10 largest hedge funds in the world has the number one position in Atmos Energy Corporation (NYSE:ATO), worth close to $51.5 million, comprising 0.1% of its total 13F portfolio. The second most bullish fund manager is Cliff Asness of AQR Capital Management, with a $49.9 million position; 0.1% of its 13F portfolio is allocated to the stock. Other peers with similar optimism encompass Jonathan Barrett and Paul Segal’s Luminus Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and D. E. Shaw’s D E Shaw. We should note that Luminus Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.