We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in third quarter, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Aon PLC (NYSE:AON).

Hedge fund interest in Aon PLC (NYSE:AON) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Johnson Controls, Inc. (NYSE:JCI), SYSCO Corporation (NYSE:SYY), and Kellogg Company (NYSE:K) to gather more data points.

Follow Aon Plc (NYSE:AON)

Follow Aon Plc (NYSE:AON)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

ZIDO SUN/Shutterstock.com

Keeping this in mind, let’s view the recent action encompassing Aon PLC (NYSE:AON).

Hedge fund activity in Aon PLC (NYSE:AON)

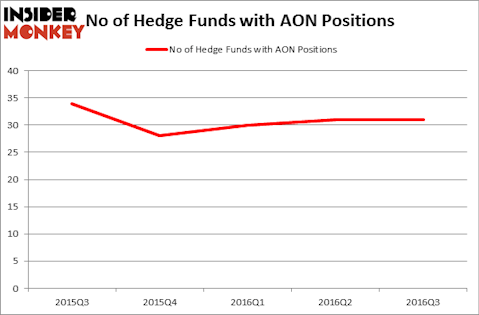

At the end of the third quarter, a total of 31 of the hedge funds tracked by Insider Monkey held long positions in Aon PLC, unchanged from one quarter earlier. With hedge funds’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Boykin Curry’s Eagle Capital Management has the number one position in Aon PLC (NYSE:AON), worth close to $1.40 billion, amounting to 6% of its total 13F portfolio. On Eagle Capital Management’s heels is First Pacific Advisors LLC, managed by Robert Rodriguez and Steven Romick, which holds a $615.3 million position; the fund has 5.1% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass Charles de Vaulx’s International Value Advisers, Ken Griffin’s Citadel Investment Group and Jonathan Bloomberg’s BloombergSen.

On the other hand, there also were some funds that sold out their entire stakes in Aon PLC during the third quarter. At the top of the heap, Gavin M. Abrams’s Abrams Bison Investments said goodbye to the largest position of the “upper crust” of funds monitored by Insider Monkey, comprising close to $86.5 million in stock, and Andreas Halvorsen’s Viking Global was right behind this move, as the fund said goodbye to about $76.9 million worth of shares. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Aon PLC (NYSE:AON). These stocks are Johnson Controls, Inc. (NYSE:JCI), SYSCO Corporation (NYSE:SYY), Kellogg Company (NYSE:K), and Intuit Inc. (NASDAQ:INTU). This group of stocks’ market values are similar to AON’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JCI | 55 | 2833460 | 23 |

| SYY | 33 | 3556925 | 2 |

| K | 39 | 1306871 | 12 |

| INTU | 26 | 697375 | -2 |

As you can see these stocks had an average of 38 hedge funds with bullish positions and the average amount invested in these stocks was $2.10 billion. That figure was $2.67 billion in AON’s case. Johnson Controls, Inc. (NYSE:JCI) is the most popular stock in this table. On the other hand Intuit Inc. (NASDAQ:INTU) is the least popular one with only 26 bullish hedge fund positions. Aon PLC (NYSE:AON) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Johnson Controls, Inc. (NYSE:JCI) might be a better candidate to consider a long position.

Disclosure: None