The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Amarin Corporation plc (ADR) (NASDAQ:AMRN).

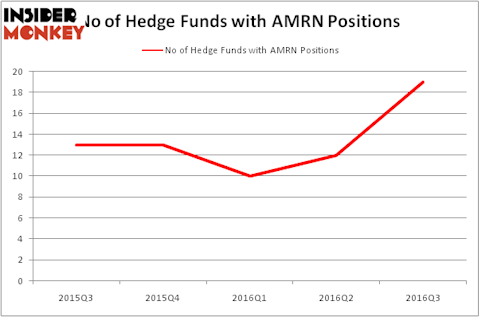

Amarin Corporation plc (ADR) (NASDAQ:AMRN) shareholders have witnessed an increase in hedge fund sentiment of late. AMRN was in 19 hedge funds’ portfolios at the end of the third quarter of 2016. There were 12 hedge funds in our database with AMRN positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as TETRA Technologies, Inc. (NYSE:TTI), Ashford Hospitality Trust, Inc. (NYSE:AHT), and Great Southern Bancorp, Inc. (NASDAQ:GSBC) to gather more data points.

Follow Amarin Corp Plc (NASDAQ:AMRN)

Follow Amarin Corp Plc (NASDAQ:AMRN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

How are hedge funds trading Amarin Corporation plc (ADR) (NASDAQ:AMRN)?

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 58% from the second quarter of 2016. By comparison, 13 hedge funds held shares or bullish call options in AMRN heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Mitchell Blutt’s Consonance Capital Management has the number one position in Amarin Corporation plc (ADR) (NASDAQ:AMRN), worth close to $78.6 million, corresponding to 7.6% of its total 13F portfolio. Sitting at the No. 2 spot is Baker Bros. Advisors, led by Julian Baker and Felix Baker, holding a $65.8 million position. Some other peers that are bullish comprise Dmitry Balyasny’s Balyasny Asset Management and Kevin Kotler’s Broadfin Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key money managers have jumped into Amarin Corporation plc (ADR) (NASDAQ:AMRN) headfirst. Consonance Capital Management established the biggest position in Amarin Corporation plc (ADR) (NASDAQ:AMRN). Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management also made a $15.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Thomas Steyer’s Farallon Capital, James Dondero’s Highland Capital Management, and Joseph Edelman’s Perceptive Advisors.

Let’s go over hedge fund activity in other stocks similar to Amarin Corporation plc (ADR) (NASDAQ:AMRN). We will take a look at TETRA Technologies, Inc. (NYSE:TTI), Ashford Hospitality Trust, Inc. (NYSE:AHT), Great Southern Bancorp, Inc. (NASDAQ:GSBC), and Sucampo Pharmaceuticals, Inc. (NASDAQ:SCMP). This group of stocks’ market values are closest to AMRN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TTI | 17 | 67275 | -6 |

| AHT | 13 | 27968 | -1 |

| GSBC | 6 | 11433 | -1 |

| SCMP | 14 | 41189 | -1 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $37 million. That figure was $222 million in AMRN’s case. TETRA Technologies, Inc. (NYSE:TTI) is the most popular stock in this table. On the other hand Great Southern Bancorp, Inc. (NASDAQ:GSBC) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Amarin Corporation plc (ADR) (NASDAQ:AMRN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None