Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2014) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Aclaris Therapeutics, Inc. (NASDAQ:ACRS).

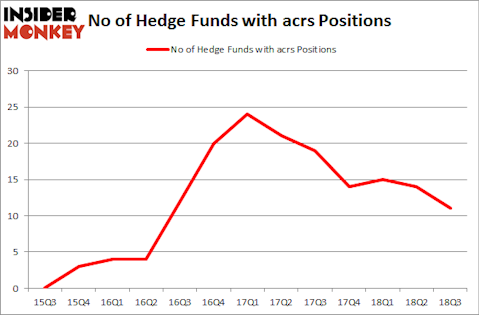

Aclaris Therapeutics, Inc. (NASDAQ:ACRS) investors should be aware of a decrease in support from the world’s most elite money managers recently. ACRS was in 11 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with ACRS holdings at the end of the previous quarter. Our calculations also showed that acrs isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a gander at the latest hedge fund action surrounding Aclaris Therapeutics, Inc. (NASDAQ:ACRS).

What have hedge funds been doing with Aclaris Therapeutics, Inc. (NASDAQ:ACRS)?

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of -21% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in ACRS at the beginning of this year. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were adding to their stakes significantly (or already accumulated large positions).

Among these funds, Deerfield Management held the most valuable stake in Aclaris Therapeutics, Inc. (NASDAQ:ACRS), which was worth $44.9 million at the end of the third quarter. On the second spot was Polar Capital which amassed $21 million worth of shares. Moreover, D E Shaw, Citadel Investment Group, and Rock Springs Capital Management were also bullish on Aclaris Therapeutics, Inc. (NASDAQ:ACRS), allocating a large percentage of their portfolios to this stock.

Due to the fact that Aclaris Therapeutics, Inc. (NASDAQ:ACRS) has faced declining sentiment from the smart money, we can see that there exists a select few hedge funds that slashed their positions entirely heading into Q3. Intriguingly, Anand Parekh’s Alyeska Investment Group dropped the largest position of all the hedgies monitored by Insider Monkey, totaling an estimated $12.3 million in stock. Steve Cohen’s fund, Point72 Asset Management, also cut its stock, about $5.4 million worth. These moves are interesting, as total hedge fund interest dropped by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Aclaris Therapeutics, Inc. (NASDAQ:ACRS). These stocks are Cutera, Inc. (NASDAQ:CUTR), Corenergy Infrastructure Trust Inc (NYSE:CORR), Translate Bio, Inc. (NASDAQ:TBIO), and AV Homes Inc (NASDAQ:AVHI). This group of stocks’ market caps match ACRS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CUTR | 13 | 77299 | -4 |

| CORR | 7 | 57285 | 1 |

| TBIO | 11 | 54532 | -4 |

| AVHI | 11 | 52144 | -3 |

| Average | 10.5 | 60315 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $144 million in ACRS’s case. Cutera, Inc. (NASDAQ:CUTR) is the most popular stock in this table. On the other hand Corenergy Infrastructure Trust Inc (NYSE:CORR) is the least popular one with only 7 bullish hedge fund positions. Aclaris Therapeutics, Inc. (NASDAQ:ACRS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CUTR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.