The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 873 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 30th. In this article we look at what those investors think of VIZIO Holding Corp. (NYSE:VZIO).

Hedge fund interest in VIZIO Holding Corp. (NYSE:VZIO) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that VZIO isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings). At the end of this article we will also compare VZIO to other stocks including Antero Midstream Corp (NYSE:AM), Neogen Corporation (NASDAQ:NEOG), and New Residential Investment Corp (NYSE:NRZ) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 185.4% since March 2017 and outperformed the S&P 500 ETFs by more than 79 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Now we’re going to review the latest hedge fund action surrounding VIZIO Holding Corp. (NYSE:VZIO).

Do Hedge Funds Think VZIO Is A Good Stock To Buy Now?

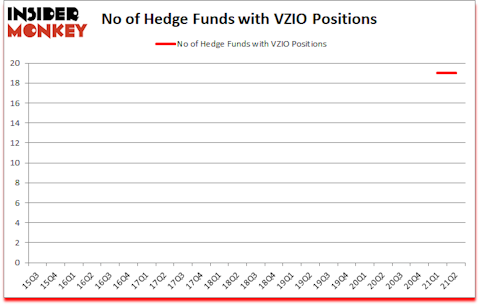

At second quarter’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards VZIO over the last 24 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Driehaus Capital held the most valuable stake in VIZIO Holding Corp. (NYSE:VZIO), which was worth $24.8 million at the end of the second quarter. On the second spot was Ophir Asset Management which amassed $21.4 million worth of shares. Point72 Asset Management, Citadel Investment Group, and Adage Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Ophir Asset Management allocated the biggest weight to VIZIO Holding Corp. (NYSE:VZIO), around 3.77% of its 13F portfolio. Tenzing Global Investors is also relatively very bullish on the stock, dishing out 2.68 percent of its 13F equity portfolio to VZIO.

Judging by the fact that VIZIO Holding Corp. (NYSE:VZIO) has witnessed bearish sentiment from the entirety of the hedge funds we track, logic holds that there were a few funds that decided to sell off their full holdings last quarter. It’s worth mentioning that Jerry Kochanski’s Shelter Haven Capital Management said goodbye to the biggest position of the “upper crust” of funds watched by Insider Monkey, comprising about $24.1 million in stock. Joseph Samuels’s fund, Islet Management, also said goodbye to its stock, about $7.3 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as VIZIO Holding Corp. (NYSE:VZIO) but similarly valued. We will take a look at Antero Midstream Corp (NYSE:AM), Neogen Corporation (NASDAQ:NEOG), New Residential Investment Corp (NYSE:NRZ), IDACORP Inc (NYSE:IDA), Colliers International Group Inc (NASDAQ:CIGI), Watts Water Technologies Inc (NYSE:WTS), and International Game Technology PLC (NYSE:IGT). All of these stocks’ market caps resemble VZIO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AM | 16 | 106977 | -1 |

| NEOG | 12 | 37911 | 2 |

| NRZ | 20 | 129871 | 5 |

| IDA | 15 | 77067 | -2 |

| CIGI | 17 | 825694 | 3 |

| WTS | 18 | 471866 | 0 |

| IGT | 32 | 326678 | -5 |

| Average | 18.6 | 282295 | 0.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.6 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $128 million in VZIO’s case. International Game Technology PLC (NYSE:IGT) is the most popular stock in this table. On the other hand Neogen Corporation (NASDAQ:NEOG) is the least popular one with only 12 bullish hedge fund positions. VIZIO Holding Corp. (NYSE:VZIO) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for VZIO is 52.5. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and beat the market again by 1.6 percentage points. Unfortunately VZIO wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on VZIO were disappointed as the stock returned -25.5% since the end of June (through 10/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Vizio Holding Corp. (NYSE:VZIO)

Follow Vizio Holding Corp. (NYSE:VZIO)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Largest Coal Companies

- 10 Best 3D Printing Stocks to Buy Now

- 11 Best Lithium and Battery Stocks To Buy

Disclosure: None. This article was originally published at Insider Monkey.