Last month I started a new monthly article series in which I’ll be monitoring the health of DivGro, my portfolio of dividend growth stocks. These pulse articles will be strategy focused. I’ll provide updated fair value estimates and compare those estimates to current market prices. I’ll also provide various charts to visualize recent performance. My goal is to help inform investment decisions.

In contrast, my monthly review articles present a summary of the past month’s activities along with a snapshot of DivGro’s current state, including metrics such as projected annual dividend income (PADI), average yield on cost (YoC), percentage payback and projected annual yield.

Discounted Stocks

Stocks in my portfolio that trade at a discount to fair value are candidates for further investment. Before I buy more shares, though, I’d want to analyze the stock to see if I still like the fundamentals. Conversely, if a stock is trading at a premium to fair value, I’d want to avoid buying more shares. Doing so would increase the average cost basis and reduce the average YoC.

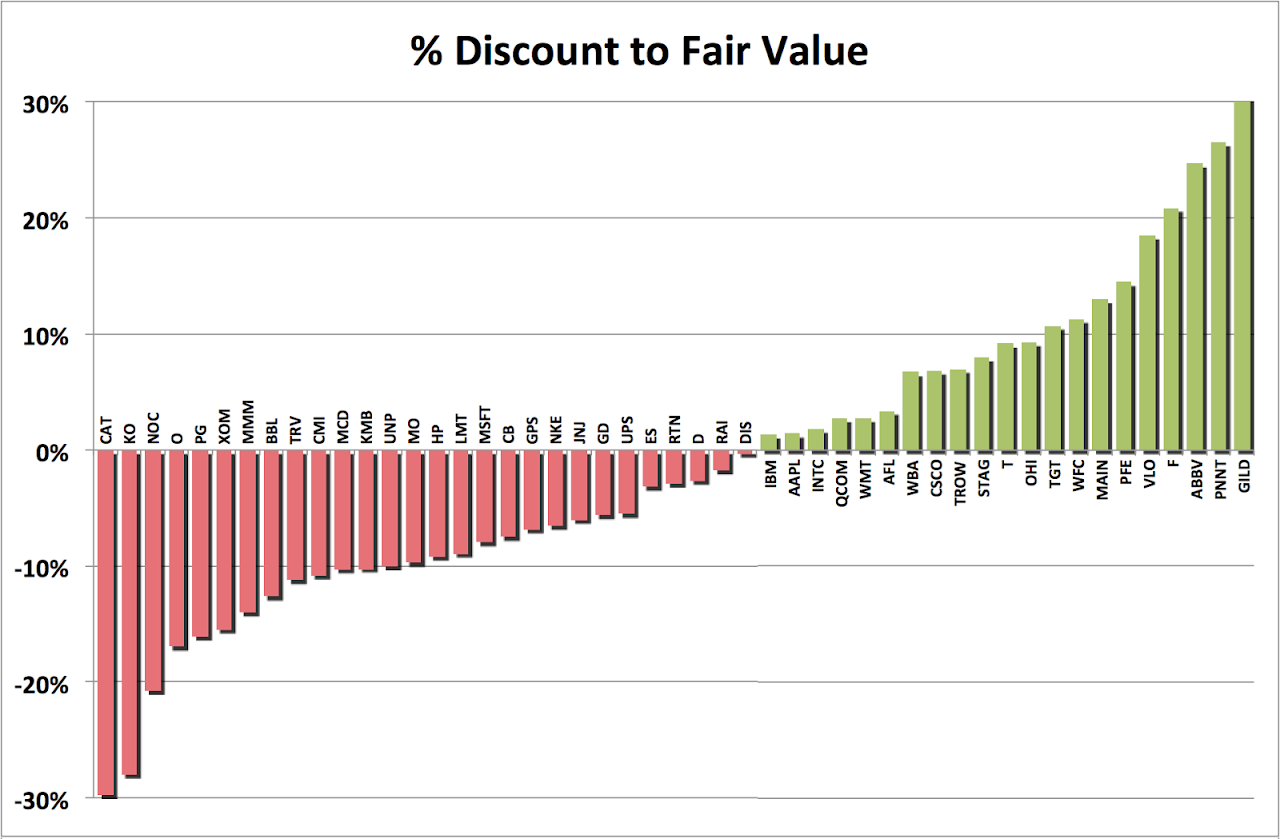

The following chart shows the percentage discount to fair value of all the stocks in my portfolio. Green bars represent discounts, and red bars represent premiums (or negative discounts):

|

I like to buy stocks trading at discounts of 10% or better. According to the chart above, nine stocks are trading more than 10% below fair value. But are these stocks suitable for further investment?

As a first past test, I rank the stocks based on fundamentals and assign a 7-star rating to each stock. Stocks that earn at least five stars are suitable for further analysis:

| Gilead Sciences, Inc (GILD) | • discount 32% | • ★★★★★☆☆ |

| PennantPark Investment (PNNT) | • discount 27% | • ★☆☆☆☆☆☆ |

| AbbVie Inc (ABBV) | • discount 27% | • ★★★★★★☆ |

| Ford Motor Company (F) | • discount 21% | • ★★★★★★☆ |

| Valero Energy Corporation (VLO) | • discount 19% | • ★★★★★★☆ |

| Pfizer Inc (PFE) | • discount 14% | • ★★★☆☆☆☆ |

| Main Street Capital (MAIN) | • discount 13% | • ★★★★☆☆☆ |

| Wells Fargo & Company (WFC) | • discount 11% | • ★★★★★☆☆ |

| Target Corporation (TGT) | • discount 11% | • ★★★★★★☆ |

Of these discounted stocks, I’ve invested less than 1% of available capital in TGT and WFC. For comparison, the average position size in DivGro is 1.64%.

I have an open short put option on TGT. If shares trade below $65 on or before 20 January 2017, the chances are that I’ll get to buy 100 shares at a cost basis of less than $62 per share (when accounting for the option premium).

As for WFC, I’m not convinced that I want to increase my position after the revelation that bank employees committed fraud as part of an incentive scheme. In fact, it looks like the fallout (1) will impact business negatively for a long time to come.

The other 6-star stocks look quite attractive. I already own 600 shares of F, and I’m already leveraging that position through covered calls. I could execute the same strategy for ABBV, as I own 100 shares. Another possibility would be to sell a put option at a suitable strike price. Doing so would allow me to collect an option premium and perhaps increase my position in ABBV at a favorable entry price.

Finally, increasing my position in VLO at the current market price would lower my cost basis and simultaneously raise YoC. VLO yields 4.3%.