Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track more than 700 prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Discover Financial Services (NYSE:DFS) in this article.

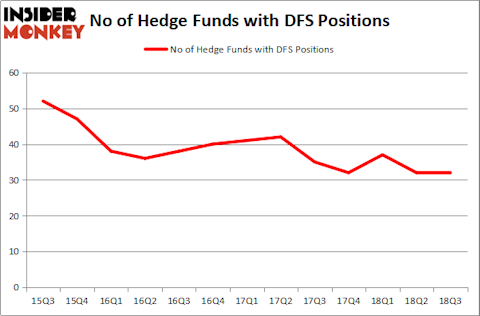

Discover Financial Services (NYSE:DFS) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 32 hedge funds’ portfolios at the end of September. At the end of this article we will also compare DFS to other stocks including Energy Transfer Partners LP (NYSE:ETP), Imperial Oil Limited (NYSEAMEX:IMO), and Continental Resources, Inc. (NYSE:CLR) to get a better sense of its popularity.

In the financial world there are a multitude of tools market participants employ to appraise their stock investments. Some of the most useful tools are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can outpace the broader indices by a superb margin (see the details here).

We’re going to view the latest hedge fund action encompassing Discover Financial Services (NYSE:DFS).

How have hedgies been trading Discover Financial Services (NYSE:DFS)?

At Q3’s end, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, no change from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DFS over the last 13 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, Diamond Hill Capital held the most valuable stake in Discover Financial Services (NYSE:DFS), which was worth $540.4 million at the end of the third quarter. On the second spot was Arrowstreet Capital which amassed $200.8 million worth of shares. Moreover, AQR Capital Management, GLG Partners, and Millennium Management were also bullish on Discover Financial Services (NYSE:DFS), allocating a large percentage of their portfolios to this stock.

Since Discover Financial Services (NYSE:DFS) has faced bearish sentiment from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of fund managers that elected to cut their entire stakes by the end of the third quarter. Intriguingly, Lee Ainslie’s Maverick Capital cut the biggest stake of the 700 funds tracked by Insider Monkey, worth close to $6.7 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dropped about $4.4 million worth. These moves are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Discover Financial Services (NYSE:DFS) but similarly valued. These stocks are Energy Transfer Partners LP (NYSE:ETP), Imperial Oil Limited (NYSEAMEX:IMO), Continental Resources, Inc. (NYSE:CLR), and General Mills, Inc. (NYSE:GIS). This group of stocks’ market valuations resemble DFS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETP | 13 | 368219 | 0 |

| IMO | 17 | 110505 | 2 |

| CLR | 29 | 609433 | -4 |

| GIS | 32 | 289635 | 0 |

| Average | 22.75 | 344448 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.75 hedge funds with bullish positions and the average amount invested in these stocks was $344 million. That figure was $1.06 billion in DFS’s case. General Mills, Inc. (NYSE:GIS) is the most popular stock in this table. On the other hand Energy Transfer Partners LP (NYSE:ETP) is the least popular one with only 13 bullish hedge fund positions. Discover Financial Services (NYSE:DFS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GIS might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.