Is Digi International Inc. (NASDAQ:DGII) a good bet right now? We like to analyze hedge fund sentiment before conducting days of in-depth research. We do so because hedge funds and other elite investors have numerous Ivy League graduates, expert network advisers, and supply chain tipsters working or consulting for them. There is not a shortage of news stories covering failed hedge fund investments and it is a fact that hedge funds’ picks don’t beat the market 100% of the time, but their consensus picks have historically done very well and have outperformed the market after adjusting for risk.

Digi International Inc. (NASDAQ:DGII) investors should pay attention to a decrease in hedge fund interest of late. Our calculations also showed that DGII isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are numerous indicators investors have at their disposal to evaluate publicly traded companies. A duo of the less known indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the top hedge fund managers can trounce their index-focused peers by a significant amount (see the details here).

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a glance at the new hedge fund action surrounding Digi International Inc. (NASDAQ:DGII).

Hedge fund activity in Digi International Inc. (NASDAQ:DGII)

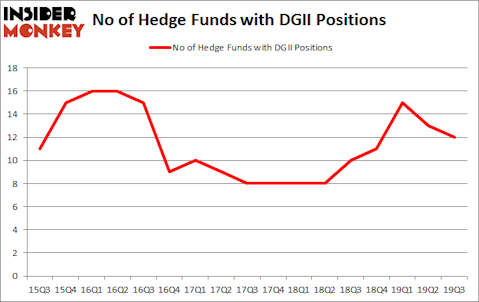

At Q3’s end, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the previous quarter. The graph below displays the number of hedge funds with bullish position in DGII over the last 17 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Among these funds, Royce & Associates held the most valuable stake in Digi International Inc. (NASDAQ:DGII), which was worth $16.2 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $10.5 million worth of shares. North Run Capital, AQR Capital Management, and Manatuck Hill Partners were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position North Run Capital allocated the biggest weight to Digi International Inc. (NASDAQ:DGII), around 5.76% of its 13F portfolio. Manatuck Hill Partners is also relatively very bullish on the stock, dishing out 1.14 percent of its 13F equity portfolio to DGII.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Millennium Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified DGII as a viable investment and initiated a position in the stock.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Digi International Inc. (NASDAQ:DGII) but similarly valued. We will take a look at Inseego Corp. (NASDAQ:INSG), Karuna Therapeutics, Inc. (NASDAQ:KRTX), Village Super Market, Inc. (NASDAQ:VLGEA), and Switchback Energy Acquisition Corporation (NYSE:SBE). This group of stocks’ market caps resemble DGII’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| INSG | 8 | 16483 | 0 |

| KRTX | 9 | 22332 | 0 |

| VLGEA | 8 | 40571 | 0 |

| SBE | 17 | 109079 | 17 |

| Average | 10.5 | 47116 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $49 million in DGII’s case. Switchback Energy Acquisition Corporation (NYSE:SBE) is the most popular stock in this table. On the other hand Inseego Corp. (NASDAQ:INSG) is the least popular one with only 8 bullish hedge fund positions. Digi International Inc. (NASDAQ:DGII) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on DGII as the stock returned 31% during the fourth quarter (through the end of November) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.