The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 867 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. Hedge funds’ consensus stock picks performed spectacularly over the last 3 years, but 2022 hasn’t been kind to hedge funds. In this article we look at how hedge funds traded U.S. Bancorp (NYSE:USB) and determine whether the smart money was really smart about this stock.

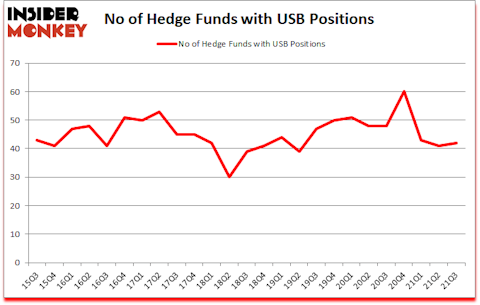

Is U.S. Bancorp (NYSE:USB) a safe investment today? Hedge funds were in an optimistic mood. The number of long hedge fund positions went up by 1 lately. U.S. Bancorp (NYSE:USB) was in 42 hedge funds’ portfolios at the end of September. The all time high for this statistic is 60. Our calculations also showed that USB isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). There were 41 hedge funds in our database with USB holdings at the end of June.

David Harding of Winton Capital Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to view the new hedge fund action surrounding U.S. Bancorp (NYSE:USB).

Do Hedge Funds Think USB Is A Good Stock To Buy Now?

At the end of September, a total of 42 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 2% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in USB over the last 25 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Warren Buffett’s Berkshire Hathaway has the number one position in U.S. Bancorp (NYSE:USB), worth close to $7.5143 billion, corresponding to 2.6% of its total 13F portfolio. On Berkshire Hathaway’s heels is Yacktman Asset Management, led by Donald Yacktman, holding a $279.4 million position; 2.7% of its 13F portfolio is allocated to the company. Remaining professional money managers that hold long positions include Brandon Haley’s Holocene Advisors, and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position BlueMar Capital Management allocated the biggest weight to U.S. Bancorp (NYSE:USB), around 4.33% of its 13F portfolio. Prana Capital Management is also relatively very bullish on the stock, setting aside 3.67 percent of its 13F equity portfolio to USB.

Consequently, key money managers have jumped into U.S. Bancorp (NYSE:USB) headfirst. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most valuable position in U.S. Bancorp (NYSE:USB). Marshall Wace LLP had $7.6 million invested in the company at the end of the quarter. Sahm Adrangi’s Kerrisdale Capital also initiated a $3.7 million position during the quarter. The following funds were also among the new USB investors: David Harding’s Winton Capital Management, Mark McMeans’s Brasada Capital Management, and Paul Tudor Jones’s Tudor Investment Corp.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as U.S. Bancorp (NYSE:USB) but similarly valued. These stocks are Gilead Sciences, Inc. (NASDAQ:GILD), PetroChina Company Limited (NYSE:PTR), Automatic Data Processing (NASDAQ:ADP), Uber Technologies, Inc. (NYSE:UBER), Altria Group Inc (NYSE:MO), Brookfield Asset Management Inc. (NYSE:BAM), and Mercadolibre Inc (NASDAQ:MELI). This group of stocks’ market values are similar to USB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GILD | 55 | 1751615 | 1 |

| PTR | 7 | 94903 | -1 |

| ADP | 43 | 3616230 | 2 |

| UBER | 143 | 10766637 | 8 |

| MO | 45 | 829789 | -2 |

| BAM | 32 | 2498829 | -2 |

| MELI | 68 | 4371182 | -6 |

| Average | 56.1 | 3418455 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 56.1 hedge funds with bullish positions and the average amount invested in these stocks was $3418 million. That figure was $8391 million in USB’s case. Uber Technologies, Inc. (NYSE:UBER) is the most popular stock in this table. On the other hand PetroChina Company Limited (NYSE:PTR) is the least popular one with only 7 bullish hedge fund positions. U.S. Bancorp (NYSE:USB) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for USB is 39.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and surpassed the market again by 3.6 percentage points. Unfortunately, USB wasn’t nearly as popular as these 5 stocks (hedge fund sentiment was quite bearish); USB investors were disappointed as the stock returned -1.3% since the end of September (through 1/31) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as all of these stocks already outperformed the market since 2019.

Follow Us Bancorp (NYSE:USB)

Follow Us Bancorp (NYSE:USB)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Most Annoying Email Newsletters to Sign Horrible People Up to

- 10 Best American Dividend Stocks to Invest In

- 15 Largest Gas Companies In The US

Disclosure: None. This article was originally published at Insider Monkey.