The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 867 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30th. Hedge funds’ consensus stock picks performed spectacularly over the last 3 years, but 2022 hasn’t been kind to hedge funds. In this article we look at how hedge funds traded Bunge Limited (NYSE:BG) and determine whether the smart money was really smart about this stock.

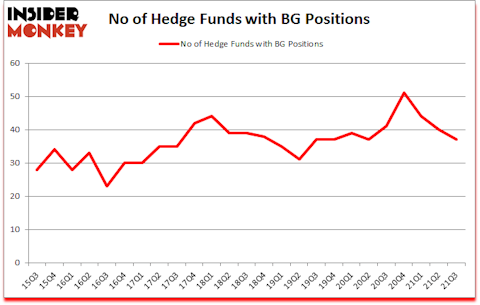

Bunge Limited (NYSE:BG) investors should pay attention to a decrease in enthusiasm from smart money lately. Bunge Limited (NYSE:BG) was in 37 hedge funds’ portfolios at the end of September. The all time high for this statistic is 51. There were 40 hedge funds in our database with BG holdings at the end of June. Our calculations also showed that BG isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. With all of this in mind we’re going to go over the fresh hedge fund action surrounding Bunge Limited (NYSE:BG).

Do Hedge Funds Think BG Is A Good Stock To Buy Now?

At third quarter’s end, a total of 37 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from one quarter earlier. On the other hand, there were a total of 41 hedge funds with a bullish position in BG a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Bunge Limited (NYSE:BG) was held by Candlestick Capital Management, which reported holding $94.3 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $69.9 million position. Other investors bullish on the company included Millennium Management, Alyeska Investment Group, and MFP Investors. In terms of the portfolio weights assigned to each position Yost Capital Management allocated the biggest weight to Bunge Limited (NYSE:BG), around 10.7% of its 13F portfolio. MFP Investors is also relatively very bullish on the stock, designating 4.09 percent of its 13F equity portfolio to BG.

Since Bunge Limited (NYSE:BG) has faced bearish sentiment from the smart money, it’s easy to see that there lies a certain “tier” of hedge funds who sold off their positions entirely last quarter. It’s worth mentioning that Robert Pohly’s Samlyn Capital cut the biggest investment of the 750 funds followed by Insider Monkey, totaling close to $38.5 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also said goodbye to its stock, about $18.1 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 3 funds last quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Bunge Limited (NYSE:BG) but similarly valued. These stocks are Universal Health Services, Inc. (NYSE:UHS), Axon Enterprise, Inc. (NASDAQ:AXON), Lamar Advertising Company (NASDAQ:LAMR), Natura &Co Holding S.A. (NYSE:NTCO), C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), Regency Centers Corp (NASDAQ:REG), and Cna Financial Corporation (NYSE:CNA). This group of stocks’ market caps are similar to BG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UHS | 43 | 751314 | 2 |

| AXON | 32 | 529860 | 8 |

| LAMR | 30 | 445462 | -2 |

| NTCO | 6 | 46852 | 1 |

| CHRW | 20 | 287994 | -11 |

| REG | 19 | 158467 | -6 |

| CNA | 12 | 63809 | -1 |

| Average | 23.1 | 326251 | -1.3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.1 hedge funds with bullish positions and the average amount invested in these stocks was $326 million. That figure was $539 million in BG’s case. Universal Health Services, Inc. (NYSE:UHS) is the most popular stock in this table. On the other hand Natura &Co Holding S.A. (NYSE:NTCO) is the least popular one with only 6 bullish hedge fund positions. Bunge Limited (NYSE:BG) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for BG is 65.7. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 29.6% in 2021 and still beat the market by 3.6 percentage points. Hedge funds were also right about betting on BG as the stock returned 22.2% since the end of Q3 (through 1/31) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Bungeltd (NYSE:BG)

Follow Bungeltd (NYSE:BG)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Shipping Stocks that Pay Dividends

- 15 Best Semiconductor Stocks to Buy Now

- Top 20 Gold Mining Companies

Disclosure: None. This article was originally published at Insider Monkey.