Is The Sherwin-Williams Company (NYSE:SHW) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

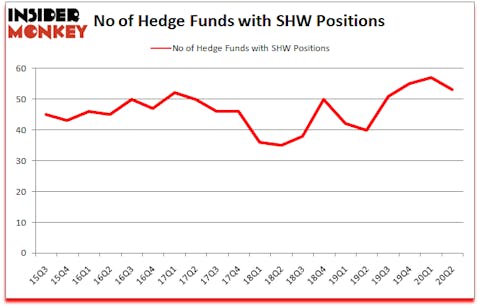

Is The Sherwin-Williams Company (NYSE:SHW) undervalued? Hedge funds were in a bearish mood. The number of long hedge fund positions retreated by 4 in recent months. The Sherwin-Williams Company (NYSE:SHW) was in 53 hedge funds’ portfolios at the end of the second quarter of 2020. The all time high for this statistics is 57. Our calculations also showed that SHW isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings and see the video for a quick look at the top 5 stocks). There were 57 hedge funds in our database with SHW positions at the end of the first quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that a select group of hedge fund holdings outperformed the S&P 500 ETFs by 56 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 34% through August 17th. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Richard Chilton of Chilton Investment Company

At Insider Monkey we scour multiple sources to uncover the next great investment idea. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than quadrupled this year. We are trying to identify other EV revolution winners, so we are checking out this under-the-radar lithium stock. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website to get excerpts of these letters in your inbox. With all of this in mind we’re going to go over the new hedge fund action surrounding The Sherwin-Williams Company (NYSE:SHW).

How have hedgies been trading The Sherwin-Williams Company (NYSE:SHW)?

At the end of the second quarter, a total of 53 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from one quarter earlier. On the other hand, there were a total of 40 hedge funds with a bullish position in SHW a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

The largest stake in The Sherwin-Williams Company (NYSE:SHW) was held by Farallon Capital, which reported holding $258.9 million worth of stock at the end of September. It was followed by Chilton Investment Company with a $236.6 million position. Other investors bullish on the company included Viking Global, Diamond Hill Capital, and Two Sigma Advisors. In terms of the portfolio weights assigned to each position Chilton Investment Company allocated the biggest weight to The Sherwin-Williams Company (NYSE:SHW), around 7.81% of its 13F portfolio. Bristol Gate Capital Partners is also relatively very bullish on the stock, designating 4.53 percent of its 13F equity portfolio to SHW.

Since The Sherwin-Williams Company (NYSE:SHW) has witnessed falling interest from the aggregate hedge fund industry, we can see that there exists a select few money managers that slashed their entire stakes in the second quarter. It’s worth mentioning that Dan Loeb’s Third Point said goodbye to the biggest position of the “upper crust” of funds monitored by Insider Monkey, worth close to $68.9 million in stock. Brandon Haley’s fund, Holocene Advisors, also said goodbye to its stock, about $34.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest dropped by 4 funds in the second quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as The Sherwin-Williams Company (NYSE:SHW) but similarly valued. These stocks are Autodesk, Inc. (NASDAQ:ADSK), Brookfield Asset Management Inc. (NYSE:BAM), Moody’s Corporation (NYSE:MCO), Humana Inc (NYSE:HUM), Northrop Grumman Corporation (NYSE:NOC), Global Payments Inc (NYSE:GPN), and Sea Limited (NYSE:SE). This group of stocks’ market valuations are closest to SHW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ADSK | 67 | 3014972 | 2 |

| BAM | 33 | 1001293 | -4 |

| MCO | 61 | 10770558 | 11 |

| HUM | 73 | 4697967 | 3 |

| NOC | 47 | 990004 | 2 |

| GPN | 66 | 3311740 | -1 |

| SE | 82 | 6358325 | 6 |

| Average | 61.3 | 4306408 | 2.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 61.3 hedge funds with bullish positions and the average amount invested in these stocks was $4306 million. That figure was $1831 million in SHW’s case. Sea Limited (NYSE:SE) is the most popular stock in this table. On the other hand Brookfield Asset Management Inc. (NYSE:BAM) is the least popular one with only 33 bullish hedge fund positions. The Sherwin-Williams Company (NYSE:SHW) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for SHW is 49.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 30% in 2020 through October 23rd and still beat the market by 21 percentage points. A small number of hedge funds were also right about betting on SHW as the stock returned 18.5% since the end of the second quarter (through 10/23) and outperformed the market by an even larger margin.

Follow Sherwin Williams Co (NYSE:SHW)

Follow Sherwin Williams Co (NYSE:SHW)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.