The latest 13F reporting period has come and gone, and Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. Now, we are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article you are going to find out whether hedge funds thoughtWolverine World Wide, Inc. (NYSE:WWW) was a good investment heading into the second quarter and how the stock traded in comparison to the top hedge fund picks.

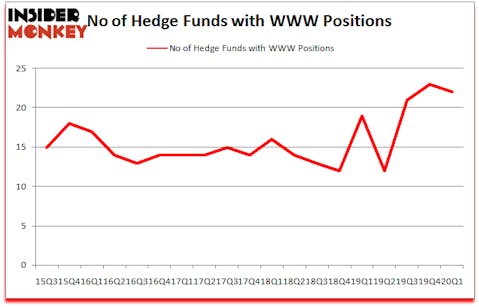

Wolverine World Wide, Inc. (NYSE:WWW) shareholders have witnessed a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that WWW isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Fred DiSanto of Ancora Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Now we’re going to take a look at the new hedge fund action regarding Wolverine World Wide, Inc. (NYSE:WWW).

How have hedgies been trading Wolverine World Wide, Inc. (NYSE:WWW)?

At Q1’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from one quarter earlier. On the other hand, there were a total of 19 hedge funds with a bullish position in WWW a year ago. With the smart money’s capital changing hands, there exists a select group of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Diamond Hill Capital held the most valuable stake in Wolverine World Wide, Inc. (NYSE:WWW), which was worth $18.1 million at the end of the third quarter. On the second spot was Millennium Management which amassed $11.1 million worth of shares. Citadel Investment Group, Royce & Associates, and Ancora Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Ancora Advisors allocated the biggest weight to Wolverine World Wide, Inc. (NYSE:WWW), around 0.35% of its 13F portfolio. Invenomic Capital Management is also relatively very bullish on the stock, setting aside 0.21 percent of its 13F equity portfolio to WWW.

Since Wolverine World Wide, Inc. (NYSE:WWW) has faced bearish sentiment from the smart money, it’s safe to say that there is a sect of hedgies that slashed their full holdings by the end of the first quarter. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the biggest position of the 750 funds followed by Insider Monkey, worth an estimated $11.8 million in stock. Michael Gelband’s fund, ExodusPoint Capital, also dumped its stock, about $0.7 million worth. These moves are interesting, as total hedge fund interest dropped by 1 funds by the end of the first quarter.

Let’s now review hedge fund activity in other stocks similar to Wolverine World Wide, Inc. (NYSE:WWW). These stocks are MakeMyTrip Limited (NASDAQ:MMYT), Renasant Corporation (NASDAQ:RNST), LTC Properties Inc (NYSE:LTC), and International Game Technology PLC (NYSE:IGT). This group of stocks’ market valuations are similar to WWW’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MMYT | 9 | 32911 | -5 |

| RNST | 12 | 18604 | 0 |

| LTC | 11 | 25083 | 1 |

| IGT | 25 | 55994 | -5 |

| Average | 14.25 | 33148 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $33 million. That figure was $85 million in WWW’s case. International Game Technology PLC (NYSE:IGT) is the most popular stock in this table. On the other hand MakeMyTrip Limited (NASDAQ:MMYT) is the least popular one with only 9 bullish hedge fund positions. Wolverine World Wide, Inc. (NYSE:WWW) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on WWW as the stock returned 57.3% in Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Wolverine World Wide Inc (NYSE:WWW)

Follow Wolverine World Wide Inc (NYSE:WWW)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.