Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 4.5 years and analyze what the smart money thinks of Sirius XM Holdings Inc (NASDAQ:SIRI) based on that data and determine whether they were really smart about the stock.

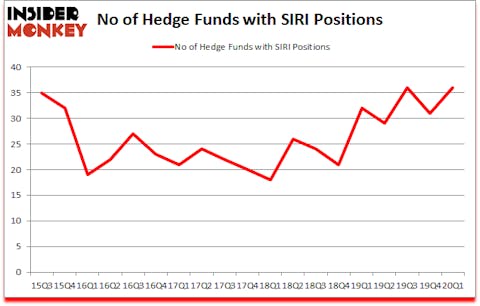

Is Sirius XM Holdings Inc (NASDAQ:SIRI) ready to rally soon? Hedge funds were buying. The number of long hedge fund positions inched up by 5 lately. Our calculations also showed that SIRI isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). SIRI was in 36 hedge funds’ portfolios at the end of March. There were 31 hedge funds in our database with SIRI positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are perceived as slow, old investment tools of the past. While there are greater than 8000 funds in operation today, Our researchers look at the upper echelon of this group, around 850 funds. It is estimated that this group of investors orchestrate most of the smart money’s total capital, and by observing their finest equity investments, Insider Monkey has unsheathed numerous investment strategies that have historically outrun the broader indices. Insider Monkey’s flagship short hedge fund strategy outperformed the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Our portfolio of short stocks lost 36% since February 2017 (through May 18th) even though the market was up 30% during the same period. We just shared a list of 8 short targets in our latest quarterly update .

William Martin of Raging Capital Management

At Insider Monkey we scour multiple sources to uncover the next great investment idea. There is a lot of volatility in the markets and this presents amazing investment opportunities from time to time. For example, this trader claims to deliver juiced up returns with one trade a week, so we are checking out his highest conviction idea. A second trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. Now we’re going to take a gander at the latest hedge fund action encompassing Sirius XM Holdings Inc (NASDAQ:SIRI).

What have hedge funds been doing with Sirius XM Holdings Inc (NASDAQ:SIRI)?

At the end of the first quarter, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 16% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in SIRI over the last 18 quarters. With hedgies’ capital changing hands, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Warren Buffett’s Berkshire Hathaway has the largest position in Sirius XM Holdings Inc (NASDAQ:SIRI), worth close to $654.1 million, amounting to 0.4% of its total 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, holding a $268 million position; 0.3% of its 13F portfolio is allocated to the company. Other peers that hold long positions comprise Ken Griffin’s Citadel Investment Group, Stuart J. Zimmer’s Zimmer Partners and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. In terms of the portfolio weights assigned to each position DPM Capital allocated the biggest weight to Sirius XM Holdings Inc (NASDAQ:SIRI), around 8.46% of its 13F portfolio. Raging Capital Management is also relatively very bullish on the stock, setting aside 6.11 percent of its 13F equity portfolio to SIRI.

With a general bullishness amongst the heavyweights, key money managers have jumped into Sirius XM Holdings Inc (NASDAQ:SIRI) headfirst. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, created the most valuable position in Sirius XM Holdings Inc (NASDAQ:SIRI). Arrowstreet Capital had $37.3 million invested in the company at the end of the quarter. Pedro Escudero’s DPM Capital also made a $11 million investment in the stock during the quarter. The following funds were also among the new SIRI investors: William C. Martin’s Raging Capital Management, Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors, and Greg Eisner’s Engineers Gate Manager.

Let’s also examine hedge fund activity in other stocks similar to Sirius XM Holdings Inc (NASDAQ:SIRI). We will take a look at Southern Copper Corporation (NYSE:SCCO), Amphenol Corporation (NYSE:APH), Dow Inc. (NYSE:DOW), and Otis Worldwide Corporation (NYSE:OTIS). This group of stocks’ market values are similar to SIRI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SCCO | 19 | 134406 | -1 |

| APH | 42 | 604137 | 6 |

| DOW | 38 | 375922 | 4 |

| OTIS | 4 | 13927 | 4 |

| Average | 25.75 | 282098 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.75 hedge funds with bullish positions and the average amount invested in these stocks was $282 million. That figure was $1135 million in SIRI’s case. Amphenol Corporation (NYSE:APH) is the most popular stock in this table. On the other hand Otis Worldwide Corporation (NYSE:OTIS) is the least popular one with only 4 bullish hedge fund positions. Sirius XM Holdings Inc (NASDAQ:SIRI) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but beat the market by 15.5 percentage points. Unfortunately SIRI wasn’t nearly as popular as these 10 stocks and hedge funds that were betting on SIRI were disappointed as the stock returned 19.1% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Follow Sirius Xm Holdings Inc. (NASDAQ:(SIRI))

Follow Sirius Xm Holdings Inc. (NASDAQ:(SIRI))

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.