At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Quotient Technology Inc (NYSE:QUOT) at the end of the first quarter and determine whether the smart money was really smart about this stock.

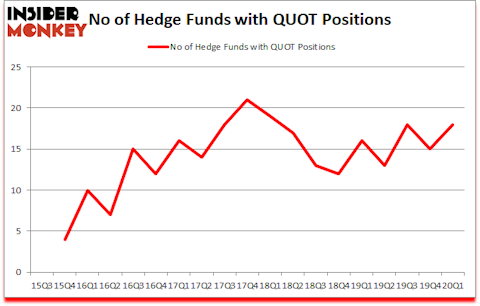

Quotient Technology Inc (NYSE:QUOT) has experienced an increase in activity from the world’s largest hedge funds of late. Our calculations also showed that QUOT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are a multitude of formulas market participants can use to value their holdings. A pair of the most underrated formulas are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the best investment managers can trounce the broader indices by a healthy margin (see the details here).

Bill Miller of Miller Value Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. We go through lists like the 10 most profitable companies in America to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. Now let’s take a peek at the fresh hedge fund action regarding Quotient Technology Inc (NYSE:QUOT).

How have hedgies been trading Quotient Technology Inc (NYSE:QUOT)?

At Q1’s end, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 20% from the previous quarter. The graph below displays the number of hedge funds with bullish position in QUOT over the last 18 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Cynthia Paul’s Lynrock Lake has the largest position in Quotient Technology Inc (NYSE:QUOT), worth close to $113.9 million, comprising 11.2% of its total 13F portfolio. Sitting at the No. 2 spot is Miller Value Partners, led by Bill Miller, holding a $47.3 million position; 3% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors that hold long positions encompass Douglas T. Granat’s Trigran Investments, Richard Mashaal’s Rima Senvest Management and Renaissance Technologies. In terms of the portfolio weights assigned to each position Lynrock Lake allocated the biggest weight to Quotient Technology Inc (NYSE:QUOT), around 11.22% of its 13F portfolio. Trigran Investments is also relatively very bullish on the stock, dishing out 7.71 percent of its 13F equity portfolio to QUOT.

Now, some big names were breaking ground themselves. Engineers Gate Manager, managed by Greg Eisner, created the most valuable position in Quotient Technology Inc (NYSE:QUOT). Engineers Gate Manager had $0.4 million invested in the company at the end of the quarter. Michael Gelband’s ExodusPoint Capital also initiated a $0.1 million position during the quarter. The other funds with new positions in the stock are Minhua Zhang’s Weld Capital Management and Karim Abbadi and Edward McBride’s Centiva Capital.

Let’s go over hedge fund activity in other stocks similar to Quotient Technology Inc (NYSE:QUOT). We will take a look at SMART Global Holdings, Inc. (NASDAQ:SGH), Linx S.A. (NYSE:LINX), Range Resources Corp. (NYSE:RRC), and Revlon Inc (NYSE:REV). This group of stocks’ market caps are similar to QUOT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SGH | 17 | 264406 | -1 |

| LINX | 5 | 11501 | 1 |

| RRC | 23 | 154075 | -6 |

| REV | 36 | 178239 | -2 |

| Average | 20.25 | 152055 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $152 million. That figure was $242 million in QUOT’s case. Revlon Inc (NYSE:REV) is the most popular stock in this table. On the other hand Linx S.A. (NYSE:LINX) is the least popular one with only 5 bullish hedge fund positions. Quotient Technology Inc (NYSE:QUOT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 18.6% in 2020 through July 27th and surpassed the market by 17.1 percentage points. Unfortunately QUOT wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); QUOT investors were disappointed as the stock returned 19.8% since Q1 and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Quotient Technology Inc. (NYSE:QUOT)

Follow Quotient Technology Inc. (NYSE:QUOT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.