How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding ONEOK, Inc. (NYSE:OKE) and determine whether hedge funds had an edge regarding this stock.

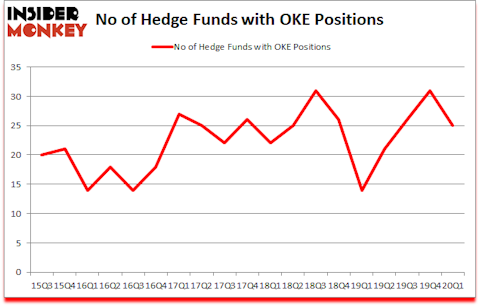

ONEOK, Inc. (NYSE:OKE) shareholders have witnessed a decrease in enthusiasm from smart money of late. OKE was in 25 hedge funds’ portfolios at the end of the first quarter of 2020. There were 31 hedge funds in our database with OKE holdings at the end of the previous quarter. Our calculations also showed that OKE isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are many signals investors can use to evaluate publicly traded companies. Some of the best signals are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the best money managers can outpace the broader indices by a solid amount (see the details here).

Clint Carlson of Carlson Capital

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, on one site we found out that NBA champion Isiah Thomas is now the CEO of this cannabis company. The same site also talks about a snack manufacturer that’s growing at 30% annually. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Keeping this in mind we’re going to take a peek at the fresh hedge fund action surrounding ONEOK, Inc. (NYSE:OKE).

How are hedge funds trading ONEOK, Inc. (NYSE:OKE)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from one quarter earlier. By comparison, 14 hedge funds held shares or bullish call options in OKE a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the number one position in ONEOK, Inc. (NYSE:OKE). Arrowstreet Capital has a $45.3 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Millennium Management, led by Israel Englander, holding a $25 million position; 0.1% of its 13F portfolio is allocated to the company. Other members of the smart money that hold long positions contain Cliff Asness’s AQR Capital Management, Ken Griffin’s Citadel Investment Group and Phill Gross and Robert Atchinson’s Adage Capital Management. In terms of the portfolio weights assigned to each position Heronetta Management allocated the biggest weight to ONEOK, Inc. (NYSE:OKE), around 3.24% of its 13F portfolio. Brasada Capital Management is also relatively very bullish on the stock, designating 0.95 percent of its 13F equity portfolio to OKE.

Judging by the fact that ONEOK, Inc. (NYSE:OKE) has experienced falling interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of funds that decided to sell off their positions entirely in the first quarter. Interestingly, Stuart J. Zimmer’s Zimmer Partners sold off the largest investment of all the hedgies followed by Insider Monkey, valued at close to $56.8 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund said goodbye to about $19.4 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest dropped by 6 funds in the first quarter.

Let’s go over hedge fund activity in other stocks similar to ONEOK, Inc. (NYSE:OKE). We will take a look at Medical Properties Trust, Inc. (NYSE:MPW), Fair Isaac Corporation (NYSE:FICO), Elanco Animal Health Incorporated (NYSE:ELAN), and NICE Ltd (NASDAQ:NICE). This group of stocks’ market values match OKE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MPW | 16 | 164781 | 2 |

| FICO | 41 | 1225484 | -4 |

| ELAN | 26 | 340715 | 3 |

| NICE | 22 | 373814 | 3 |

| Average | 26.25 | 526199 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $526 million. That figure was $135 million in OKE’s case. Fair Isaac Corporation (NYSE:FICO) is the most popular stock in this table. On the other hand Medical Properties Trust, Inc. (NYSE:MPW) is the least popular one with only 16 bullish hedge fund positions. ONEOK, Inc. (NYSE:OKE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th and still beat the market by 15.5 percentage points. A small number of hedge funds were also right about betting on OKE as the stock returned 57.4% during the second quarter and outperformed the market by an even larger margin.

Follow Oneok Inc W (NYSE:OKE)

Follow Oneok Inc W (NYSE:OKE)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.