The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. We are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article we look at how hedge funds traded Nutrien Ltd. (NYSE:NTR) and determine whether the smart money was really smart about this stock.

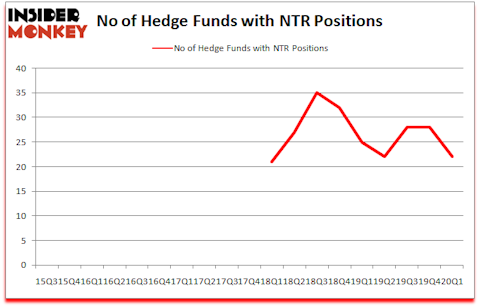

Nutrien Ltd. (NYSE:NTR) was in 22 hedge funds’ portfolios at the end of March. NTR shareholders have witnessed a decrease in support from the world’s most elite money managers lately. There were 28 hedge funds in our database with NTR holdings at the end of the previous quarter. Our calculations also showed that NTR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, on one site we found out that NBA champion Isiah Thomas is now the CEO of this cannabis company. The same site also talks about a snack manufacturer that’s growing at 30% annually. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. With all of this in mind let’s take a glance at the recent hedge fund action regarding Nutrien Ltd. (NYSE:NTR).

How have hedgies been trading Nutrien Ltd. (NYSE:NTR)?

At Q1’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -21% from the previous quarter. On the other hand, there were a total of 25 hedge funds with a bullish position in NTR a year ago. With hedge funds’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Adage Capital Management, managed by Phill Gross and Robert Atchinson, holds the number one position in Nutrien Ltd. (NYSE:NTR). Adage Capital Management has a $52.6 million position in the stock, comprising 0.2% of its 13F portfolio. The second largest stake is held by Heathbridge Capital Management, led by Robert Richards, holding a $28 million position; 7.5% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions consist of Joseph Sirdevan’s Galibier Capital Management, Paul Marshall and Ian Wace’s Marshall Wace LLP and Renaissance Technologies. In terms of the portfolio weights assigned to each position Moerus Capital Management allocated the biggest weight to Nutrien Ltd. (NYSE:NTR), around 12.69% of its 13F portfolio. Galibier Capital Management is also relatively very bullish on the stock, dishing out 12 percent of its 13F equity portfolio to NTR.

Due to the fact that Nutrien Ltd. (NYSE:NTR) has experienced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there were a few hedgies who sold off their full holdings by the end of the first quarter. Interestingly, John Horseman’s Horseman Capital Management said goodbye to the biggest investment of all the hedgies followed by Insider Monkey, comprising about $7.6 million in stock. Noam Gottesman’s fund, GLG Partners, also said goodbye to its stock, about $6.1 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 6 funds by the end of the first quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Nutrien Ltd. (NYSE:NTR). These stocks are Xilinx, Inc. (NASDAQ:XLNX), Synopsys, Inc. (NASDAQ:SNPS), Twitter Inc (NYSE:TWTR), and Ford Motor Company (NYSE:F). This group of stocks’ market valuations are similar to NTR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XLNX | 38 | 635591 | -4 |

| SNPS | 31 | 725655 | -14 |

| TWTR | 55 | 990334 | 0 |

| F | 33 | 667079 | -3 |

| Average | 39.25 | 754665 | -5.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.25 hedge funds with bullish positions and the average amount invested in these stocks was $755 million. That figure was $270 million in NTR’s case. Twitter Inc (NYSE:TWTR) is the most popular stock in this table. On the other hand Synopsys, Inc. (NASDAQ:SNPS) is the least popular one with only 31 bullish hedge fund positions. Compared to these stocks Nutrien Ltd. (NYSE:NTR) is even less popular than SNPS. Hedge funds dodged a bullet by taking a bearish stance towards NTR. Our calculations showed that the top 10 most popular hedge fund stocks returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but managed to beat the market by 15.5 percentage points. Unfortunately NTR wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was very bearish); NTR investors were disappointed as the stock returned -4.1% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market so far in 2020.

Follow Nutrien Ltd. (NYSE:NTR)

Follow Nutrien Ltd. (NYSE:NTR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.