We know that hedge funds generate strong, risk-adjusted returns over the long run, which is why imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, professional investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do. However, it is still a good idea to keep an eye on hedge fund activity. With this in mind, let’s examine the smart money sentiment towards Chemed Corporation (NYSE:CHE) and determine whether hedge funds skillfully traded this stock.

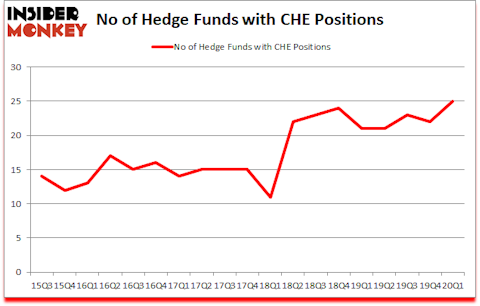

Chemed Corporation (NYSE:CHE) investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. Our calculations also showed that CHE isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are tons of signals shareholders employ to assess their stock investments. A pair of the best signals are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the best investment managers can trounce the broader indices by a significant margin (see the details here).

Donald Sussman of Paloma Partners

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, legal marijuana is one of the fastest growing industries right now, so we are checking out stock pitches like “the Starbucks of cannabis” to identify the next tenbagger. We go through lists like the 10 most profitable companies in the world to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Now let’s view the key hedge fund action encompassing Chemed Corporation (NYSE:CHE).

How have hedgies been trading Chemed Corporation (NYSE:CHE)?

At the end of the first quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. On the other hand, there were a total of 21 hedge funds with a bullish position in CHE a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the largest position in Chemed Corporation (NYSE:CHE). Fisher Asset Management has a $126.5 million position in the stock, comprising 0.2% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, with a $120.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism encompass Mario Gabelli’s GAMCO Investors, Ken Griffin’s Citadel Investment Group and Noam Gottesman’s GLG Partners. In terms of the portfolio weights assigned to each position Miura Global Management allocated the biggest weight to Chemed Corporation (NYSE:CHE), around 1.12% of its 13F portfolio. GAMCO Investors is also relatively very bullish on the stock, dishing out 0.42 percent of its 13F equity portfolio to CHE.

Now, key money managers have been driving this bullishness. Miura Global Management, managed by Pasco Alfaro / Richard Tumure, assembled the most valuable position in Chemed Corporation (NYSE:CHE). Miura Global Management had $4.3 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also made a $1.1 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Algert and Kevin Coldiron’s Algert Coldiron Investors, Greg Eisner’s Engineers Gate Manager, and Hoon Kim’s Quantinno Capital.

Let’s now review hedge fund activity in other stocks similar to Chemed Corporation (NYSE:CHE). These stocks are Vornado Realty Trust (NYSE:VNO), WABCO Holdings Inc. (NYSE:WBC), AngloGold Ashanti Limited (NYSE:AU), and Luckin Coffee Inc. (NASDAQ:LK). This group of stocks’ market valuations are closest to CHE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VNO | 25 | 224296 | -6 |

| WBC | 32 | 1395171 | -2 |

| AU | 19 | 399420 | 2 |

| LK | 36 | 1056167 | 3 |

| Average | 28 | 768764 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $769 million. That figure was $381 million in CHE’s case. Luckin Coffee Inc. (NASDAQ:LK) is the most popular stock in this table. On the other hand AngloGold Ashanti Limited (NYSE:AU) is the least popular one with only 19 bullish hedge fund positions. Chemed Corporation (NYSE:CHE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th and surpassed the market by 15.5 percentage points. Unfortunately CHE wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); CHE investors were disappointed as the stock returned 4.2% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Cardinal Financial Corp (NASDAQ:CFNL)

Follow Cardinal Financial Corp (NASDAQ:CFNL)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.