How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) and determine whether hedge funds had an edge regarding this stock.

BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) investors should pay attention to an increase in support from the world’s most elite money managers lately. Our calculations also showed that BJ isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Ken Griffin of Citadel Investment Group

At Insider Monkey we scour multiple sources to uncover the next great investment idea. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so we are checking out this tiny lithium stock. Keeping this in mind we’re going to analyze the recent hedge fund action encompassing BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ).

What does smart money think about BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ)?

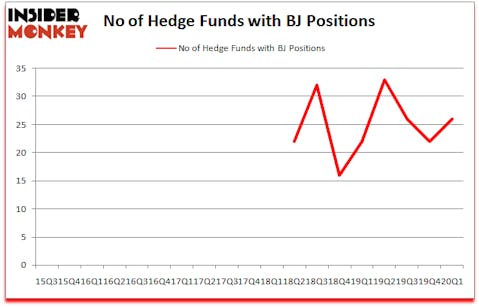

At Q1’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 18% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in BJ over the last 18 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ken Griffin’s Citadel Investment Group has the number one position in BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), worth close to $69.1 million, corresponding to less than 0.1%% of its total 13F portfolio. Sitting at the No. 2 spot is Sirios Capital Management, managed by John Brennan, which holds a $24.4 million position; 2.2% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors with similar optimism consist of Paul Marshall and Ian Wace’s Marshall Wace LLP, Louis Bacon’s Moore Global Investments and Anand Parekh’s Alyeska Investment Group. In terms of the portfolio weights assigned to each position Game Creek Capital allocated the biggest weight to BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ), around 2.77% of its 13F portfolio. Sirios Capital Management is also relatively very bullish on the stock, designating 2.16 percent of its 13F equity portfolio to BJ.

Consequently, specific money managers were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the biggest position in BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ). Marshall Wace LLP had $11.1 million invested in the company at the end of the quarter. Louis Bacon’s Moore Global Investments also made a $8.5 million investment in the stock during the quarter. The following funds were also among the new BJ investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Brad Stephens’s Six Columns Capital, and Sean Murphy’s Game Creek Capital.

Let’s now review hedge fund activity in other stocks similar to BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ). We will take a look at Zai Lab Limited (NASDAQ:ZLAB), Cullen/Frost Bankers, Inc. (NYSE:CFR), First Citizens BancShares Inc. (NASDAQ:FCNCA), and The Hanover Insurance Group, Inc. (NYSE:THG). This group of stocks’ market caps are similar to BJ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZLAB | 22 | 364537 | -4 |

| CFR | 18 | 40108 | 0 |

| FCNCA | 17 | 129488 | -6 |

| THG | 24 | 134965 | 3 |

| Average | 20.25 | 167275 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.25 hedge funds with bullish positions and the average amount invested in these stocks was $167 million. That figure was $157 million in BJ’s case. The Hanover Insurance Group, Inc. (NYSE:THG) is the most popular stock in this table. On the other hand First Citizens BancShares Inc. (NASDAQ:FCNCA) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks BJ’s Wholesale Club Holdings, Inc. (NYSE:BJ) is more popular among hedge funds. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks returned 12.3% in 2020 through June 30th but still managed to beat the market by 15.5 percentage points. Hedge funds were also right about betting on BJ as the stock returned 46.3% in Q2 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Bj's Wholesale Club Holdings Inc. (NYSE:BJ)

Follow Bj's Wholesale Club Holdings Inc. (NYSE:BJ)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.