How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Atara Biotherapeutics Inc (NASDAQ:ATRA) and determine whether hedge funds had an edge regarding this stock.

Atara Biotherapeutics Inc (NASDAQ:ATRA) investors should pay attention to an increase in hedge fund interest in recent months. Our calculations also showed that ATRA isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

Today there are a large number of gauges stock market investors have at their disposal to assess their stock investments. A pair of the most innovative gauges are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can trounce their index-focused peers by a solid margin (see the details here).

Seth Klarman of Baupost Group

At Insider Monkey we scour multiple sources to uncover the next great investment idea. With Federal Reserve creating trillions of dollars out of thin air, we believe gold prices will keep increasing. So, we are checking out gold stocks like this small gold mining company. We go through lists like the 10 most profitable companies in America to pick the best large-cap stocks to buy. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. With all of this in mind we’re going to take a look at the latest hedge fund action surrounding Atara Biotherapeutics Inc (NASDAQ:ATRA).

Hedge fund activity in Atara Biotherapeutics Inc (NASDAQ:ATRA)

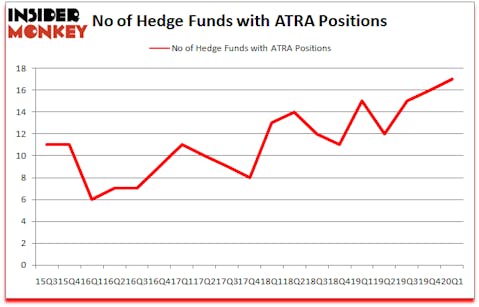

Heading into the second quarter of 2020, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 6% from the fourth quarter of 2019. Below, you can check out the change in hedge fund sentiment towards ATRA over the last 18 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Baupost Group, managed by Seth Klarman, holds the most valuable position in Atara Biotherapeutics Inc (NASDAQ:ATRA). Baupost Group has a $70.7 million position in the stock, comprising 1% of its 13F portfolio. The second most bullish fund manager is Jeremy Green of Redmile Group, with a $45 million position; the fund has 1.3% of its 13F portfolio invested in the stock. Remaining members of the smart money with similar optimism include Lee Ainslie’s Maverick Capital, Roberto Mignone’s Bridger Management and Farallon Capital. In terms of the portfolio weights assigned to each position Bridger Management allocated the biggest weight to Atara Biotherapeutics Inc (NASDAQ:ATRA), around 2.21% of its 13F portfolio. Antipodean Advisors is also relatively very bullish on the stock, setting aside 1.74 percent of its 13F equity portfolio to ATRA.

Consequently, key hedge funds were breaking ground themselves. Slate Path Capital, managed by David Greenspan, established the most valuable position in Atara Biotherapeutics Inc (NASDAQ:ATRA). Slate Path Capital had $3.6 million invested in the company at the end of the quarter. Eric Chen’s Antipodean Advisors also initiated a $1.9 million position during the quarter. The other funds with brand new ATRA positions are Adam Usdan’s Trellus Management Company, Renaissance Technologies, and Mike Vranos’s Ellington.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Atara Biotherapeutics Inc (NASDAQ:ATRA) but similarly valued. These stocks are MeiraGTx Holdings plc (NASDAQ:MGTX), ANI Pharmaceuticals Inc (NASDAQ:ANIP), FutureFuel Corp. (NYSE:FF), and Trueblue Inc (NYSE:TBI). This group of stocks’ market values are similar to ATRA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MGTX | 17 | 170760 | -4 |

| ANIP | 12 | 47914 | -1 |

| FF | 11 | 45441 | 1 |

| TBI | 10 | 32248 | -5 |

| Average | 12.5 | 74091 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $220 million in ATRA’s case. MeiraGTx Holdings plc (NASDAQ:MGTX) is the most popular stock in this table. On the other hand Trueblue Inc (NYSE:TBI) is the least popular one with only 10 bullish hedge fund positions. Atara Biotherapeutics Inc (NASDAQ:ATRA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 18.6% in 2020 through July 27th but still beat the market by 17.1 percentage points. Hedge funds were also right about betting on ATRA as the stock returned 63.3% since Q1 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Atara Biotherapeutics Inc. (NASDAQ:ATRA)

Follow Atara Biotherapeutics Inc. (NASDAQ:ATRA)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.