At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (see why hell is coming). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR) at the end of the first quarter and determine whether the smart money was really smart about this stock.

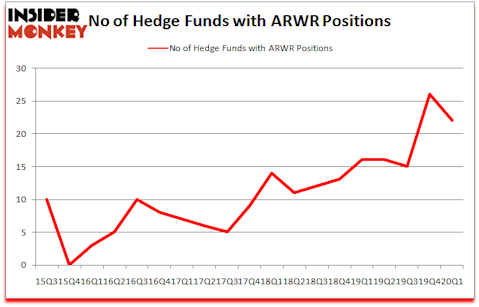

Is Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR) a cheap investment now? The smart money was becoming less confident. The number of bullish hedge fund bets shrunk by 4 lately. Our calculations also showed that ARWR isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 101% since March 2017 and outperformed the S&P 500 ETFs by more than 58 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Samuel Isaly of OrbiMed Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, on one site we found out that NBA champion Isiah Thomas is now the CEO of this cannabis company. The same site also talks about a snack manufacturer that’s growing at 30% annually. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Now we’re going to take a look at the fresh hedge fund action surrounding Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR).

How have hedgies been trading Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR)?

Heading into the second quarter of 2020, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from one quarter earlier. By comparison, 16 hedge funds held shares or bullish call options in ARWR a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Farallon Capital, holds the most valuable position in Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR). Farallon Capital has a $28.8 million position in the stock, comprising 0.3% of its 13F portfolio. Coming in second is Vivo Capital, led by Albert Cha and Frank Kung, holding a $22.1 million position; the fund has 2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that are bullish contain D. E. Shaw’s D E Shaw, Renaissance Technologies and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Aquilo Capital Management allocated the biggest weight to Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR), around 4.89% of its 13F portfolio. Vivo Capital is also relatively very bullish on the stock, earmarking 2 percent of its 13F equity portfolio to ARWR.

Because Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR) has witnessed a decline in interest from hedge fund managers, it’s easy to see that there were a few funds who sold off their entire stakes in the first quarter. Interestingly, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital cut the biggest position of all the hedgies followed by Insider Monkey, valued at close to $29.9 million in stock. David Harding’s fund, Winton Capital Management, also dropped its stock, about $5.3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 4 funds in the first quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR) but similarly valued. These stocks are Mantech International Corp (NASDAQ:MANT), Crane Co. (NYSE:CR), White Mountains Insurance Group Ltd (NYSE:WTM), and Starwood Property Trust, Inc. (NYSE:STWD). This group of stocks’ market valuations match ARWR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MANT | 17 | 32174 | -6 |

| CR | 26 | 197568 | 3 |

| WTM | 16 | 133496 | 0 |

| STWD | 23 | 96766 | 2 |

| Average | 20.5 | 115001 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $115 million. That figure was $161 million in ARWR’s case. Crane Co. (NYSE:CR) is the most popular stock in this table. On the other hand White Mountains Insurance Group Ltd (NYSE:WTM) is the least popular one with only 16 bullish hedge fund positions. Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th but still beat the market by 15.5 percentage points. Hedge funds were also right about betting on ARWR as the stock returned 50.1% in Q2 and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR)

Follow Arrowhead Pharmaceuticals Inc. (NASDAQ:ARWR)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.