Insider Monkey finished processing more than 700 13F filings submitted by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of December 31st, 2018. What do these smart investors think about Wyndham Hotels & Resorts, Inc. (NYSE:WH)?

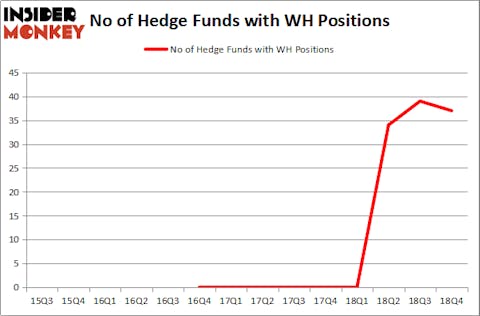

Wyndham Hotels & Resorts, Inc. (NYSE:WH) has seen a decrease in hedge fund sentiment recently. WH was in 37 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 39 hedge funds in our database with WH holdings at the end of the previous quarter. Our calculations also showed that WH isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are many methods stock traders have at their disposal to evaluate their holdings. Some of the less known methods are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the best picks of the elite hedge fund managers can trounce the market by a superb amount (see the details here).

We’re going to take a glance at the new hedge fund action regarding Wyndham Hotels & Resorts, Inc. (NYSE:WH).

What does the smart money think about Wyndham Hotels & Resorts, Inc. (NYSE:WH)?

At Q4’s end, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -5% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in WH a year ago. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Iridian Asset Management, managed by David Cohen and Harold Levy, holds the biggest position in Wyndham Hotels & Resorts, Inc. (NYSE:WH). Iridian Asset Management has a $181.5 million position in the stock, comprising 2.4% of its 13F portfolio. On Iridian Asset Management’s heels is Long Pond Capital, led by John Khoury, holding a $176.7 million position; the fund has 6.9% of its 13F portfolio invested in the stock. Other peers that hold long positions include Israel Englander’s Millennium Management, Clint Carlson’s Carlson Capital and Brett Barakett’s Tremblant Capital.

Judging by the fact that Wyndham Hotels & Resorts, Inc. (NYSE:WH) has faced declining sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few funds who sold off their positions entirely last quarter. Intriguingly, Anand Parekh’s Alyeska Investment Group dumped the biggest stake of the “upper crust” of funds watched by Insider Monkey, valued at close to $22.6 million in call options, and Jeff Lignelli’s Incline Global Management was right behind this move, as the fund cut about $13.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Wyndham Hotels & Resorts, Inc. (NYSE:WH) but similarly valued. We will take a look at Cameco Corporation (NYSE:CCJ), SAGE Therapeutics Inc (NASDAQ:SAGE), MongoDB, Inc. (NASDAQ:MDB), and Curtiss-Wright Corp. (NYSE:CW). This group of stocks’ market valuations resemble WH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCJ | 24 | 346331 | 5 |

| SAGE | 29 | 330966 | -8 |

| MDB | 23 | 510104 | 2 |

| CW | 20 | 355686 | -2 |

| Average | 24 | 385772 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $386 million. That figure was $835 million in WH’s case. SAGE Therapeutics Inc (NASDAQ:SAGE) is the most popular stock in this table. On the other hand Curtiss-Wright Corp. (NYSE:CW) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Wyndham Hotels & Resorts, Inc. (NYSE:WH) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on WH, though not to the same extent, as the stock returned 19% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.