How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding World Acceptance Corp. (NASDAQ:WRLD).

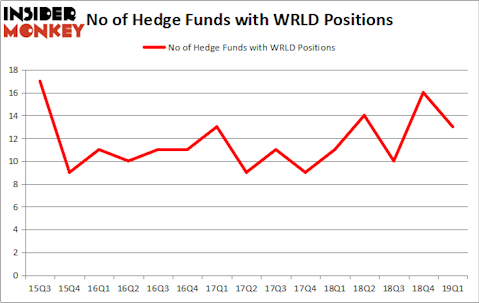

World Acceptance Corp. (NASDAQ:WRLD) shareholders have witnessed a decrease in support from the world’s most elite money managers lately. Our calculations also showed that WRLD isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the fresh hedge fund action regarding World Acceptance Corp. (NASDAQ:WRLD).

What does smart money think about World Acceptance Corp. (NASDAQ:WRLD)?

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -19% from one quarter earlier. On the other hand, there were a total of 11 hedge funds with a bullish position in WRLD a year ago. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in World Acceptance Corp. (NASDAQ:WRLD) was held by CAS Investment Partners, which reported holding $79.4 million worth of stock at the end of March. It was followed by Nantahala Capital Management with a $75.9 million position. Other investors bullish on the company included Renaissance Technologies, Bronte Capital, and General Equity Partners.

Seeing as World Acceptance Corp. (NASDAQ:WRLD) has faced bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there exists a select few funds who sold off their full holdings by the end of the third quarter. At the top of the heap, C. Jonathan Gattman’s Cloverdale Capital Management cut the largest stake of the 700 funds watched by Insider Monkey, totaling close to $10.2 million in call options. D. E. Shaw’s fund, D E Shaw, also dumped its call options, about $1.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to World Acceptance Corp. (NASDAQ:WRLD). These stocks are Tennant Company (NYSE:TNC), Trupanion Inc (NASDAQ:TRUP), Southside Bancshares, Inc. (NASDAQ:SBSI), and Sandy Spring Bancorp Inc. (NASDAQ:SASR). This group of stocks’ market valuations resemble WRLD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TNC | 15 | 83127 | 5 |

| TRUP | 13 | 154788 | 3 |

| SBSI | 7 | 65153 | 1 |

| SASR | 14 | 80840 | 1 |

| Average | 12.25 | 95977 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $239 million in WRLD’s case. Tennant Company (NYSE:TNC) is the most popular stock in this table. On the other hand Southside Bancshares, Inc. (NASDAQ:SBSI) is the least popular one with only 7 bullish hedge fund positions. World Acceptance Corp. (NASDAQ:WRLD) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on WRLD as the stock returned 31.7% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.