“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards WillScot Corporation (NASDAQ:WSC) and see how it was affected.

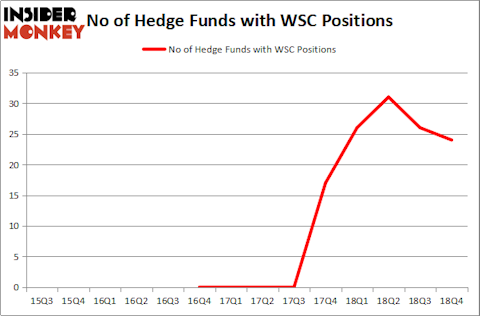

Is WillScot Corporation (NASDAQ:WSC) a buy, sell, or hold? Prominent investors are getting less optimistic. The number of bullish hedge fund positions dropped by 2 lately. Our calculations also showed that WSC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s go over the new hedge fund action encompassing WillScot Corporation (NASDAQ:WSC).

Hedge fund activity in WillScot Corporation (NASDAQ:WSC)

Heading into the first quarter of 2019, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -8% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards WSC over the last 14 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

Among these funds, Rubric Capital Management held the most valuable stake in WillScot Corporation (NASDAQ:WSC), which was worth $20.5 million at the end of the fourth quarter. On the second spot was Solus Alternative Asset Management which amassed $18.3 million worth of shares. Moreover, Venor Capital Management, Alyeska Investment Group, and Corsair Capital Management were also bullish on WillScot Corporation (NASDAQ:WSC), allocating a large percentage of their portfolios to this stock.

Due to the fact that WillScot Corporation (NASDAQ:WSC) has witnessed bearish sentiment from the smart money, it’s safe to say that there is a sect of fund managers that elected to cut their full holdings heading into Q3. Interestingly, Steve Cohen’s Point72 Asset Management dumped the biggest stake of the “upper crust” of funds watched by Insider Monkey, totaling about $7.6 million in stock. Ari Zweiman’s fund, 683 Capital Partners, also sold off its stock, about $7.4 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 2 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as WillScot Corporation (NASDAQ:WSC) but similarly valued. We will take a look at Viad Corp (NYSE:VVI), Summit Hotel Properties Inc (NYSE:INN), Quotient Technology Inc. (NYSE:QUOT), and Tivity Health, Inc. (NASDAQ:TVTY). This group of stocks’ market valuations are closest to WSC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VVI | 15 | 126783 | 3 |

| INN | 11 | 12367 | -1 |

| QUOT | 12 | 141411 | -1 |

| TVTY | 21 | 130125 | 2 |

| Average | 14.75 | 102672 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $103 million. That figure was $136 million in WSC’s case. Tivity Health, Inc. (NASDAQ:TVTY) is the most popular stock in this table. On the other hand Summit Hotel Properties Inc (NYSE:INN) is the least popular one with only 11 bullish hedge fund positions. Compared to these stocks WillScot Corporation (NASDAQ:WSC) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on WSC as the stock returned 32.7% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.