It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 15 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated a return of 19.7% during the first 2.5 months of 2019 (vs. 13.1% gain for SPY), with 93% of these stocks outperforming the benchmark. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Uniqure NV (NASDAQ:QURE).

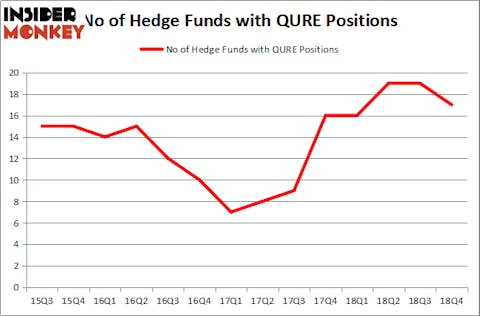

Uniqure NV (NASDAQ:QURE) shareholders have witnessed a decrease in activity from the world’s largest hedge funds of late. QURE was in 17 hedge funds’ portfolios at the end of December. There were 19 hedge funds in our database with QURE positions at the end of the previous quarter. Our calculations also showed that QURE isn’t among the 30 most popular stocks among hedge funds.

Today there are several metrics stock traders put to use to analyze their holdings. A duo of the most innovative metrics are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best investment managers can trounce the market by a healthy amount (see the details here).

We’re going to analyze the key hedge fund action regarding Uniqure NV (NASDAQ:QURE).

What have hedge funds been doing with Uniqure NV (NASDAQ:QURE)?

At the end of the fourth quarter, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of -11% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in QURE over the last 14 quarters. With hedgies’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Nantahala Capital Management was the largest shareholder of Uniqure NV (NASDAQ:QURE), with a stake worth $71.4 million reported as of the end of December. Trailing Nantahala Capital Management was Consonance Capital Management, which amassed a stake valued at $54.6 million. Redmile Group, 683 Capital Partners, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Uniqure NV (NASDAQ:QURE) has faced declining sentiment from hedge fund managers, it’s easy to see that there exists a select few money managers who were dropping their full holdings in the third quarter. Interestingly, James E. Flynn’s Deerfield Management sold off the biggest stake of the 700 funds monitored by Insider Monkey, valued at close to $8.8 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund sold off about $5.8 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Uniqure NV (NASDAQ:QURE) but similarly valued. We will take a look at Presidio, Inc. (NASDAQ:PSDO), Beneficial Bancorp, Inc. (NASDAQ:BNCL), Hercules Capital, Inc. (NYSE:HTGC), and BrightView Holdings, Inc. (NYSE:BV). This group of stocks’ market values are similar to QURE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PSDO | 6 | 4900 | -8 |

| BNCL | 12 | 81062 | 3 |

| HTGC | 11 | 17785 | 1 |

| BV | 10 | 36258 | -3 |

| Average | 9.75 | 35001 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.75 hedge funds with bullish positions and the average amount invested in these stocks was $35 million. That figure was $280 million in QURE’s case. Beneficial Bancorp, Inc. (NASDAQ:BNCL) is the most popular stock in this table. On the other hand Presidio, Inc. (NASDAQ:PSDO) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Uniqure NV (NASDAQ:QURE) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on QURE as the stock returned 83.1% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.