“Market volatility has picked up again over the past few weeks. Headlines highlight risks regarding interest rates, the Fed, China, house prices, auto sales, trade wars, and more. Uncertainty abounds. But doesn’t it always? I have no view on whether the recent volatility will continue for a while, or whether the market will be back at all-time highs before we know it. I remain focused on preserving and growing our capital, and continue to believe that the best way to do so is via a value-driven, concentrated, patient approach. I shun consensus holdings, rich valuations, and market fads, in favor of solid, yet frequently off-the-beaten-path, businesses run by excellent, aligned management teams, purchased at deep discounts to intrinsic value,” are the words of Maran Capital’s Dan Roller. His stock picks have been beating the S&P 500 Index handily. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards The Toro Company (NYSE:TTC) and see how it was affected.

Hedge fund interest in The Toro Company (NYSE:TTC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Cimarex Energy Co (NYSE:XEC), AptarGroup, Inc. (NYSE:ATR), and American Homes 4 Rent (NYSE:AMH) to gather more data points.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a glance at the recent hedge fund action regarding The Toro Company (NYSE:TTC).

How have hedgies been trading The Toro Company (NYSE:TTC)?

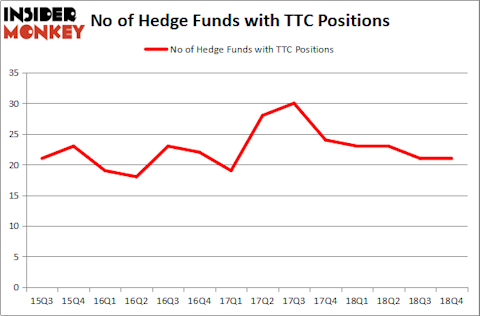

Heading into the first quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TTC over the last 14 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, Select Equity Group held the most valuable stake in The Toro Company (NYSE:TTC), which was worth $194.2 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $88.6 million worth of shares. Moreover, Impax Asset Management, GLG Partners, and Two Sigma Advisors were also bullish on The Toro Company (NYSE:TTC), allocating a large percentage of their portfolios to this stock.

Since The Toro Company (NYSE:TTC) has witnessed a decline in interest from the smart money, it’s safe to say that there is a sect of money managers who sold off their entire stakes in the third quarter. Intriguingly, Joel Greenblatt’s Gotham Asset Management said goodbye to the largest investment of the 700 funds watched by Insider Monkey, worth close to $3.5 million in stock, and Peter Algert and Kevin Coldiron’s Algert Coldiron Investors was right behind this move, as the fund cut about $2.3 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as The Toro Company (NYSE:TTC) but similarly valued. We will take a look at Cimarex Energy Co (NYSE:XEC), AptarGroup, Inc. (NYSE:ATR), American Homes 4 Rent (NYSE:AMH), and Exelixis, Inc. (NASDAQ:EXEL). This group of stocks’ market caps are similar to TTC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XEC | 28 | 1080892 | 5 |

| ATR | 17 | 62626 | 4 |

| AMH | 18 | 430651 | -2 |

| EXEL | 24 | 668199 | 1 |

| Average | 21.75 | 560592 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.75 hedge funds with bullish positions and the average amount invested in these stocks was $561 million. That figure was $472 million in TTC’s case. Cimarex Energy Co (NYSE:XEC) is the most popular stock in this table. On the other hand AptarGroup, Inc. (NYSE:ATR) is the least popular one with only 17 bullish hedge fund positions. The Toro Company (NYSE:TTC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on TTC as the stock returned 27.3% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.