The market has been volatile in the last 6 months as the Federal Reserve continued its rate hikes and then abruptly reversed its stance and uncertainty looms over trade negotiations with China. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 9 percentage points. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, though some funds increased their exposure dramatically at the end of Q4 and the beginning of Q1. In this article, we analyze what the smart money thinks of Strategic Education Inc (NASDAQ:STRA) and find out how it is affected by hedge funds’ moves.

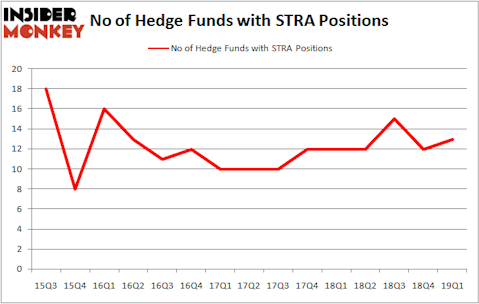

Is Strategic Education Inc (NASDAQ:STRA) a worthy stock to buy now? Hedge funds are getting more bullish. The number of long hedge fund bets improved by 1 lately. Our calculations also showed that STRA isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are viewed as worthless, outdated financial tools of yesteryear. While there are greater than 8000 funds trading at present, Our experts look at the top tier of this club, around 750 funds. These investment experts administer most of all hedge funds’ total asset base, and by keeping track of their best equity investments, Insider Monkey has spotted several investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s take a glance at the latest hedge fund action encompassing Strategic Education Inc (NASDAQ:STRA).

Hedge fund activity in Strategic Education Inc (NASDAQ:STRA)

Heading into the second quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 8% from the fourth quarter of 2018. By comparison, 12 hedge funds held shares or bullish call options in STRA a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Strategic Education Inc (NASDAQ:STRA), with a stake worth $100.5 million reported as of the end of March. Trailing Renaissance Technologies was ValueAct Capital, which amassed a stake valued at $57.3 million. Columbus Circle Investors, SG Capital Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. SG Capital Management, managed by Ken Grossman and Glen Schneider, initiated the most valuable position in Strategic Education Inc (NASDAQ:STRA). SG Capital Management had $6.8 million invested in the company at the end of the quarter. Matthew Drapkin and Steven R. Becker’s Becker Drapkin Management also initiated a $2.2 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Matthew Hulsizer’s PEAK6 Capital Management, and Noam Gottesman’s GLG Partners.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Strategic Education Inc (NASDAQ:STRA) but similarly valued. These stocks are Old National Bancorp (NASDAQ:ONB), TerraForm Power Inc (NASDAQ:TERP), AmeriGas Partners, L.P. (NYSE:APU), and Sensient Technologies Corporation (NYSE:SXT). All of these stocks’ market caps match STRA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ONB | 9 | 34803 | 2 |

| TERP | 11 | 221131 | 3 |

| APU | 6 | 9263 | 2 |

| SXT | 8 | 65991 | -7 |

| Average | 8.5 | 82797 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $83 million. That figure was $215 million in STRA’s case. TerraForm Power Inc (NASDAQ:TERP) is the most popular stock in this table. On the other hand AmeriGas Partners, L.P. (NYSE:APU) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Strategic Education Inc (NASDAQ:STRA) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on STRA as the stock returned 37.5% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.