At Insider Monkey we follow nearly 750 of the best-performing investors and even though many of them lost money in the last couple of months of 2018 (some actually delivered very strong returns), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

Sea Limited (NYSE:SE) investors should pay attention to a decrease in enthusiasm from smart money lately. Our calculations also showed that SE isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the new hedge fund action encompassing Sea Limited (NYSE:SE).

What have hedge funds been doing with Sea Limited (NYSE:SE)?

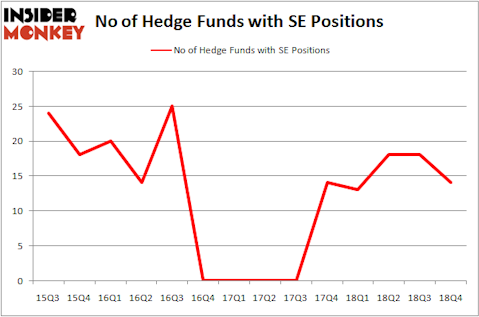

At Q4’s end, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of -22% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SE over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Tiger Global Management LLC, managed by Chase Coleman, holds the number one position in Sea Limited (NYSE:SE). Tiger Global Management LLC has a $139.2 million position in the stock, comprising 0.9% of its 13F portfolio. The second most bullish fund manager is Stephen Mandel of Lone Pine Capital, with a $44.9 million position; 0.3% of its 13F portfolio is allocated to the company. Remaining members of the smart money that are bullish consist of Nitin Saigal and Dan Jacobs’s Kora Management, Panayotis Takis Sparaggis’s Alkeon Capital Management and Kevin D. Eng’s Columbus Hill Capital Management.

Judging by the fact that Sea Limited (NYSE:SE) has faced falling interest from the smart money, logic holds that there was a specific group of hedgies who were dropping their positions entirely heading into Q3. At the top of the heap, Daniel S. Och’s OZ Management dropped the biggest position of the 700 funds followed by Insider Monkey, comprising an estimated $38.6 million in stock. Bain Capital’s fund, Brookside Capital, also said goodbye to its stock, about $9.7 million worth. These transactions are interesting, as total hedge fund interest dropped by 4 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Sea Limited (NYSE:SE) but similarly valued. We will take a look at AU Optronics Corp. (NYSE:AUO), MGIC Investment Corporation (NYSE:MTG), Southwest Gas Holdings, Inc. (NYSE:SWX), and Americold Realty Trust (NYSE:COLD). All of these stocks’ market caps match SE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AUO | 9 | 58301 | -1 |

| MTG | 35 | 358474 | 5 |

| SWX | 17 | 225927 | 4 |

| COLD | 16 | 628764 | -5 |

| Average | 19.25 | 317867 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $318 million. That figure was $335 million in SE’s case. MGIC Investment Corporation (NYSE:MTG) is the most popular stock in this table. On the other hand AU Optronics Corp. (NYSE:AUO) is the least popular one with only 9 bullish hedge fund positions. Sea Limited (NYSE:SE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on SE as the stock returned 109.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.