Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and investors’ positions as of the end of the fourth quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of Restaurant Brands International Inc (NYSE:QSR) based on that data.

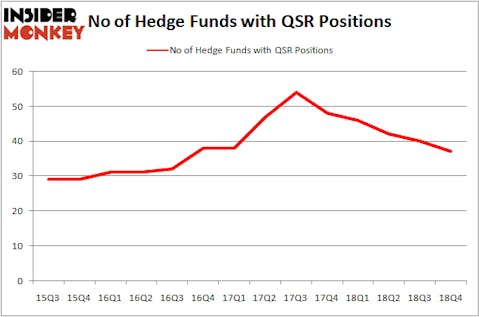

Restaurant Brands International Inc (NYSE:QSR) was in 37 hedge funds’ portfolios at the end of December. QSR has experienced a decrease in enthusiasm from smart money lately. There were 40 hedge funds in our database with QSR holdings at the end of the previous quarter. Our calculations also showed that QSR isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are seen as unimportant, outdated investment vehicles of the past. While there are over 8000 funds in operation at the moment, We hone in on the leaders of this group, approximately 750 funds. Most estimates calculate that this group of people control the lion’s share of the smart money’s total asset base, and by paying attention to their first-class picks, Insider Monkey has formulated various investment strategies that have historically outperformed the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to analyze the latest hedge fund action regarding Restaurant Brands International Inc (NYSE:QSR).

Hedge fund activity in Restaurant Brands International Inc (NYSE:QSR)

At the end of the fourth quarter, a total of 37 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in QSR over the last 14 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Pershing Square, managed by Bill Ackman, holds the number one position in Restaurant Brands International Inc (NYSE:QSR). Pershing Square has a $1.0296 billion position in the stock, comprising 17.3% of its 13F portfolio. Coming in second is Berkshire Hathaway, managed by Warren Buffett, which holds a $441.3 million position; 0.2% of its 13F portfolio is allocated to the company. Remaining hedge funds and institutional investors that hold long positions include Ricky Sandler’s Eminence Capital, Gabriel Plotkin’s Melvin Capital Management and Aaron Cowen’s Suvretta Capital Management.

Due to the fact that Restaurant Brands International Inc (NYSE:QSR) has faced falling interest from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedge funds that slashed their full holdings by the end of the third quarter. Interestingly, Richard Chilton’s Chilton Investment Company cut the largest position of the 700 funds monitored by Insider Monkey, comprising about $55.7 million in stock, and Bruce Kovner’s Caxton Associates LP was right behind this move, as the fund cut about $14.8 million worth. These moves are intriguing to say the least, as total hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Restaurant Brands International Inc (NYSE:QSR) but similarly valued. We will take a look at Franco-Nevada Corporation (NYSE:FNV), Liberty Broadband Corp (NASDAQ:LBRDK), Vulcan Materials Company (NYSE:VMC), and Liberty Broadband Corp (NASDAQ:LBRDA). This group of stocks’ market values match QSR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FNV | 23 | 425505 | 7 |

| LBRDK | 35 | 2832635 | -2 |

| VMC | 41 | 1535477 | 6 |

| LBRDA | 19 | 498774 | -3 |

| Average | 29.5 | 1323098 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $1323 million. That figure was $3179 million in QSR’s case. Vulcan Materials Company (NYSE:VMC) is the most popular stock in this table. On the other hand Liberty Broadband Corp (NASDAQ:LBRDA) is the least popular one with only 19 bullish hedge fund positions. Restaurant Brands International Inc (NYSE:QSR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Hedge funds were also right about betting on QSR as the stock returned 21.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.