Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

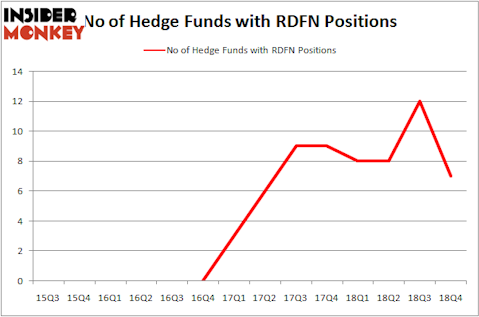

Redfin Corporation (NASDAQ:RDFN) shareholders have witnessed a decrease in hedge fund interest of late. RDFN was in 7 hedge funds’ portfolios at the end of December. There were 12 hedge funds in our database with RDFN holdings at the end of the previous quarter. Our calculations also showed that RDFN isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to review the key hedge fund action surrounding Redfin Corporation (NASDAQ:RDFN).

What have hedge funds been doing with Redfin Corporation (NASDAQ:RDFN)?

Heading into the first quarter of 2019, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -42% from the previous quarter. By comparison, 8 hedge funds held shares or bullish call options in RDFN a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Immersion Capital, managed by Michael Sidhom, holds the biggest position in Redfin Corporation (NASDAQ:RDFN). Immersion Capital has a $51.4 million position in the stock, comprising 15.4% of its 13F portfolio. On Immersion Capital’s heels is Tiger Global Management LLC, managed by Chase Coleman, which holds a $33.9 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish encompass Quincy Lee’s Ancient Art (Teton Capital), Daniel S. Och’s OZ Management and Christian Leone’s Luxor Capital Group.

Seeing as Redfin Corporation (NASDAQ:RDFN) has witnessed a decline in interest from the entirety of the hedge funds we track, logic holds that there lies a certain “tier” of funds that decided to sell off their full holdings by the end of the third quarter. It’s worth mentioning that Michael Pausic’s Foxhaven Asset Management sold off the biggest stake of the 700 funds followed by Insider Monkey, valued at close to $8.9 million in stock, and Seymour Sy Kaufman and Michael Stark’s Crosslink Capital was right behind this move, as the fund cut about $4.7 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 5 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Redfin Corporation (NASDAQ:RDFN). We will take a look at Hailiang Education Group Inc. (NASDAQ:HLG), Synaptics Incorporated (NASDAQ:SYNA), GameStop Corp. (NYSE:GME), and Weis Markets, Inc. (NYSE:WMK). This group of stocks’ market valuations are similar to RDFN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLG | 3 | 5620 | -1 |

| SYNA | 15 | 111673 | -2 |

| GME | 27 | 106964 | 7 |

| WMK | 17 | 102240 | 2 |

| Average | 15.5 | 81624 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $82 million. That figure was $114 million in RDFN’s case. GameStop Corp. (NYSE:GME) is the most popular stock in this table. On the other hand Hailiang Education Group Inc. (NASDAQ:HLG) is the least popular one with only 3 bullish hedge fund positions. Redfin Corporation (NASDAQ:RDFN) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on RDFN as the stock returned 49.2% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.