Looking for stocks with high upside potential? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 13.1% in the 2.5 months of 2019 (including dividend payments). Conversely, hedge funds’ 15 preferred S&P 500 stocks generated a return of 19.7% during the same period, with 93% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Radian Group Inc (NYSE:RDN).

Radian Group Inc (NYSE:RDN) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 24 hedge funds’ portfolios at the end of the fourth quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as MKS Instruments, Inc. (NASDAQ:MKSI), Trex Company, Inc. (NYSE:TREX), and Teladoc Inc (NYSE:TDOC) to gather more data points.

To the average investor there are dozens of tools stock traders put to use to analyze stocks. A couple of the most under-the-radar tools are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce the S&P 500 by a superb amount (see the details here).

We’re going to take a look at the fresh hedge fund action regarding Radian Group Inc (NYSE:RDN).

How have hedgies been trading Radian Group Inc (NYSE:RDN)?

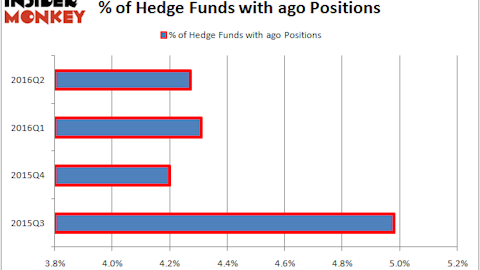

At the end of the fourth quarter, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in RDN a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

Among these funds, GLG Partners held the most valuable stake in Radian Group Inc (NYSE:RDN), which was worth $50 million at the end of the third quarter. On the second spot was Point72 Asset Management which amassed $25.8 million worth of shares. Moreover, Millennium Management, Royce & Associates, and AQR Capital Management were also bullish on Radian Group Inc (NYSE:RDN), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Radian Group Inc (NYSE:RDN) has witnessed declining sentiment from the smart money, logic holds that there was a specific group of money managers that slashed their full holdings by the end of the third quarter. It’s worth mentioning that Daniel Johnson’s Gillson Capital cut the biggest investment of the “upper crust” of funds watched by Insider Monkey, worth about $8.9 million in stock, and Dmitry Balyasny’s Balyasny Asset Management was right behind this move, as the fund said goodbye to about $3.9 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Radian Group Inc (NYSE:RDN) but similarly valued. We will take a look at MKS Instruments, Inc. (NASDAQ:MKSI), Trex Company, Inc. (NYSE:TREX), Teladoc Health, Inc. (NYSE:TDOC), and CVR Energy, Inc. (NYSE:CVI). This group of stocks’ market valuations resemble RDN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MKSI | 30 | 447623 | 5 |

| TREX | 14 | 57358 | -3 |

| TDOC | 19 | 139059 | 0 |

| CVI | 22 | 2577069 | 1 |

| Average | 21.25 | 805277 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.25 hedge funds with bullish positions and the average amount invested in these stocks was $805 million. That figure was $155 million in RDN’s case. MKS Instruments, Inc. (NASDAQ:MKSI) is the most popular stock in this table. On the other hand Trex Company, Inc. (NYSE:TREX) is the least popular one with only 14 bullish hedge fund positions. Radian Group Inc (NYSE:RDN) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on RDN as the stock returned 38.7% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.