Our extensive research has shown that imitating the smart money can generate significant returns for retail investors, which is why we track nearly 750 active prominent money managers and analyze their quarterly 13F filings. The stocks that are heavily bought by hedge funds historically outperformed the market, though there is no shortage of high profile failures like hedge funds’ recent losses in Facebook. Let’s take a closer look at what the funds we track think about Plains All American Pipeline, L.P. (NYSE:PAA) in this article.

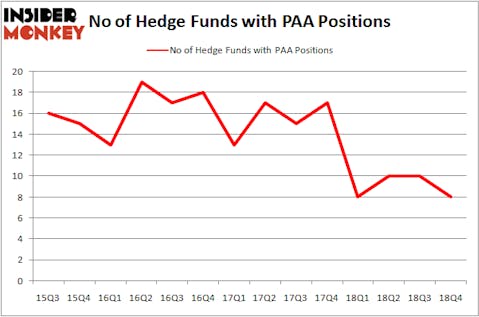

Is Plains All American Pipeline, L.P. (NYSE:PAA) a buy here? Hedge funds are taking a bearish view. The number of bullish hedge fund bets were cut by 2 lately. Our calculations also showed that PAA isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s review the latest hedge fund action surrounding Plains All American Pipeline, L.P. (NYSE:PAA).

Hedge fund activity in Plains All American Pipeline, L.P. (NYSE:PAA)

At Q4’s end, a total of 8 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from one quarter earlier. By comparison, 8 hedge funds held shares or bullish call options in PAA a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, managed by Jim Simons, holds the largest position in Plains All American Pipeline, L.P. (NYSE:PAA). Renaissance Technologies has a $20.9 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Soroban Capital Partners, managed by Eric W. Mandelblatt and Gaurav Kapadia, which holds a $10.9 million call position; 0.2% of its 13F portfolio is allocated to the company. Some other members of the smart money that hold long positions include Ken Griffin’s Citadel Investment Group, Michael Price’s MFP Investors and T Boone Pickens’s BP Capital.

Since Plains All American Pipeline, L.P. (NYSE:PAA) has witnessed a decline in interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few fund managers who were dropping their full holdings in the third quarter. Interestingly, Richard Driehaus’s Driehaus Capital dropped the biggest stake of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $0.9 million in stock. Daniel Arbess’s fund, Perella Weinberg Partners, also cut its stock, about $0.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Plains All American Pipeline, L.P. (NYSE:PAA). These stocks are Ameriprise Financial, Inc. (NYSE:AMP), Ulta Beauty, Inc. (NASDAQ:ULTA), Markel Corporation (NYSE:MKL), and First Republic Bank (NYSE:FRC). This group of stocks’ market values are similar to PAA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMP | 32 | 555326 | -1 |

| ULTA | 42 | 1040887 | 2 |

| MKL | 24 | 1101879 | 4 |

| FRC | 15 | 600397 | -8 |

| Average | 28.25 | 824622 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $825 million. That figure was $49 million in PAA’s case. Ulta Beauty, Inc. (NASDAQ:ULTA) is the most popular stock in this table. On the other hand First Republic Bank (NYSE:FRC) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Plains All American Pipeline, L.P. (NYSE:PAA) is even less popular than FRC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. A handful of hedge funds were also right about betting on PAA as the stock returned 22.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.