“The end to the U.S. Government shutdown, reports of progress on China-U.S. trade talks, and the Federal Reserve’s confirmation that it did not plan further interest rate hikes in 2019 allayed investor fears and drove U.S. markets substantially higher in the first quarter of the year. Global markets followed suit pretty much across the board delivering what some market participants described as a “V-shaped” recovery,” This is how Evermore Global Value summarized the first quarter in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

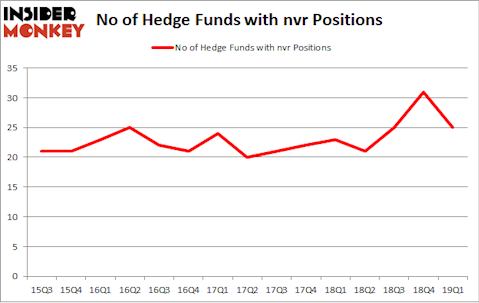

Is NVR, Inc. (NYSE:NVR) a safe investment right now? The smart money is becoming less confident. The number of long hedge fund positions were trimmed by 6 recently. Our calculations also showed that nvr isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the key hedge fund action encompassing NVR, Inc. (NYSE:NVR).

Hedge fund activity in NVR, Inc. (NYSE:NVR)

At Q1’s end, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from one quarter earlier. By comparison, 23 hedge funds held shares or bullish call options in NVR a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

Among these funds, Diamond Hill Capital held the most valuable stake in NVR, Inc. (NYSE:NVR), which was worth $296.7 million at the end of the first quarter. On the second spot was Impala Asset Management which amassed $144.9 million worth of shares. Moreover, Renaissance Technologies, Citadel Investment Group, and Two Sigma Advisors were also bullish on NVR, Inc. (NYSE:NVR), allocating a large percentage of their portfolios to this stock.

Due to the fact that NVR, Inc. (NYSE:NVR) has faced falling interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of money managers who were dropping their positions entirely heading into Q3. At the top of the heap, Richard Chilton’s Chilton Investment Company dumped the biggest position of the “upper crust” of funds tracked by Insider Monkey, comprising an estimated $13.5 million in stock. Glenn Russell Dubin’s fund, Highbridge Capital Management, also cut its stock, about $9.9 million worth. These transactions are important to note, as aggregate hedge fund interest fell by 6 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as NVR, Inc. (NYSE:NVR) but similarly valued. These stocks are China Eastern Airlines Corp. Ltd. (NYSE:CEA), Goldcorp Inc. (NYSE:GG), Alnylam Pharmaceuticals, Inc. (NASDAQ:ALNY), and Viacom, Inc. (NASDAQ:VIAB). This group of stocks’ market caps are similar to NVR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CEA | 1 | 1543 | -1 |

| GG | 35 | 871456 | 11 |

| ALNY | 26 | 753613 | -2 |

| VIAB | 38 | 936205 | 1 |

| Average | 25 | 640704 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $641 million. That figure was $883 million in NVR’s case. Viacom, Inc. (NASDAQ:VIAB) is the most popular stock in this table. On the other hand China Eastern Airlines Corp. Ltd. (NYSE:CEA) is the least popular one with only 1 bullish hedge fund positions. NVR, Inc. (NYSE:NVR) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on NVR as the stock returned 16.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.