The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 28. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Navigant Consulting, Inc. (NYSE:NCI).

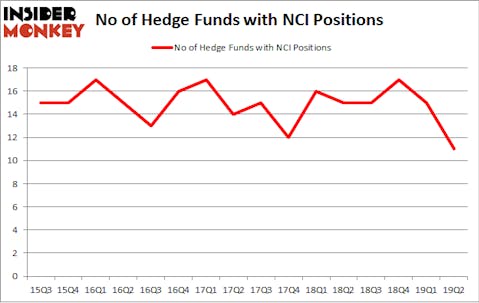

Navigant Consulting, Inc. (NYSE:NCI) was in 11 hedge funds’ portfolios at the end of the second quarter of 2019. NCI investors should pay attention to a decrease in hedge fund sentiment of late. There were 15 hedge funds in our database with NCI holdings at the end of the previous quarter. Our calculations also showed that NCI isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are dozens of gauges investors put to use to analyze their stock investments. Two of the less known gauges are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best fund managers can trounce the S&P 500 by a healthy margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the new hedge fund action surrounding Navigant Consulting, Inc. (NYSE:NCI).

What have hedge funds been doing with Navigant Consulting, Inc. (NYSE:NCI)?

Heading into the third quarter of 2019, a total of 11 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -27% from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in NCI a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

More specifically, Sunriver Management was the largest shareholder of Navigant Consulting, Inc. (NYSE:NCI), with a stake worth $19.2 million reported as of the end of March. Trailing Sunriver Management was Arrowstreet Capital, which amassed a stake valued at $13.9 million. Pzena Investment Management, Millennium Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Navigant Consulting, Inc. (NYSE:NCI) has faced falling interest from hedge fund managers, it’s safe to say that there were a few hedgies that slashed their full holdings in the second quarter. At the top of the heap, David Costen Haley’s HBK Investments sold off the largest position of the 750 funds followed by Insider Monkey, worth about $1.6 million in stock, and Alec Litowitz and Ross Laser’s Magnetar Capital was right behind this move, as the fund dropped about $0.9 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest fell by 4 funds in the second quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Navigant Consulting, Inc. (NYSE:NCI) but similarly valued. We will take a look at CIM Commercial Trust Corporation (NASDAQ:CMCT), Materialise NV (NASDAQ:MTLS), GMS Inc. (NYSE:GMS), and John B. Sanfilippo & Son, Inc. (NASDAQ:JBSS). All of these stocks’ market caps match NCI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CMCT | 1 | 394 | 0 |

| MTLS | 2 | 10287 | -2 |

| GMS | 20 | 80650 | 0 |

| JBSS | 10 | 95065 | -1 |

| Average | 8.25 | 46599 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $47 million. That figure was $52 million in NCI’s case. GMS Inc. (NYSE:GMS) is the most popular stock in this table. On the other hand CIM Commercial Trust Corporation (NASDAQ:CMCT) is the least popular one with only 1 bullish hedge fund positions. Navigant Consulting, Inc. (NYSE:NCI) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on NCI as the stock returned 20.7% during the third quarter and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.