A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended March 31, so let’s proceed with the discussion of the hedge fund sentiment on Mercury General Corporation (NYSE:MCY).

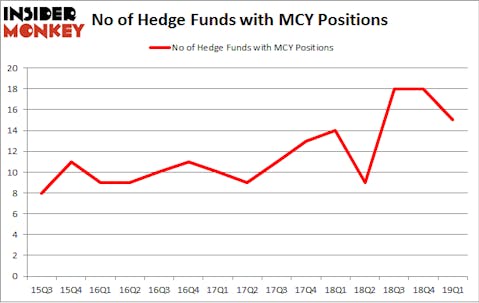

Mercury General Corporation (NYSE:MCY) was in 15 hedge funds’ portfolios at the end of the first quarter of 2019. MCY investors should pay attention to a decrease in support from the world’s most elite money managers recently. There were 18 hedge funds in our database with MCY holdings at the end of the previous quarter. Our calculations also showed that mcy isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are seen as worthless, old investment vehicles of years past. While there are more than 8000 funds in operation at the moment, Our researchers choose to focus on the crème de la crème of this group, approximately 750 funds. It is estimated that this group of investors watch over the lion’s share of all hedge funds’ total capital, and by monitoring their best investments, Insider Monkey has revealed a number of investment strategies that have historically exceeded Mr. Market. Insider Monkey’s flagship hedge fund strategy outperformed the S&P 500 index by around 5 percentage points per annum since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Noam Gottesman, GLG Partners

Let’s view the new hedge fund action regarding Mercury General Corporation (NYSE:MCY).

How have hedgies been trading Mercury General Corporation (NYSE:MCY)?

At the end of the first quarter, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -17% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in MCY a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Mercury General Corporation (NYSE:MCY), with a stake worth $76 million reported as of the end of March. Trailing Renaissance Technologies was Millennium Management, which amassed a stake valued at $16.3 million. Prospector Partners, Citadel Investment Group, and GLG Partners were also very fond of the stock, giving the stock large weights in their portfolios.

Since Mercury General Corporation (NYSE:MCY) has witnessed declining sentiment from hedge fund managers, it’s easy to see that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely by the end of the third quarter. It’s worth mentioning that David Harding’s Winton Capital Management dropped the largest stake of all the hedgies tracked by Insider Monkey, valued at an estimated $10.2 million in stock. Matthew Tewksbury’s fund, Stevens Capital Management, also dropped its stock, about $1.7 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Mercury General Corporation (NYSE:MCY) but similarly valued. These stocks are Murphy USA Inc. (NYSE:MUSA), Watts Water Technologies Inc (NYSE:WTS), Texas Capital Bancshares Inc (NASDAQ:TCBI), and TC Pipelines, LP (NYSE:TCP). This group of stocks’ market valuations are closest to MCY’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MUSA | 21 | 187051 | -3 |

| WTS | 15 | 331118 | -2 |

| TCBI | 19 | 203042 | -7 |

| TCP | 5 | 13897 | 3 |

| Average | 15 | 183777 | -2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $184 million. That figure was $143 million in MCY’s case. Murphy USA Inc. (NYSE:MUSA) is the most popular stock in this table. On the other hand TC Pipelines, LP (NYSE:TCP) is the least popular one with only 5 bullish hedge fund positions. Mercury General Corporation (NYSE:MCY) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on MCY as the stock returned 22.2% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.