Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in Q4 due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 20 stocks among hedge funds beat the S&P 500 Index ETF by 4 percentage points so far this year. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at ManTech International Corporation (NASDAQ:MANT) from the perspective of those elite funds.

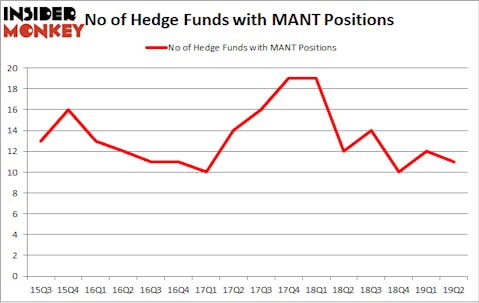

ManTech International Corporation (NASDAQ:MANT) has seen a decrease in hedge fund sentiment of late. Our calculations also showed that MANT isn’t among the 30 most popular stocks among hedge funds (view video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are plenty of methods stock market investors have at their disposal to analyze publicly traded companies. A pair of the most under-the-radar methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the top money managers can beat their index-focused peers by a very impressive margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s check out the key hedge fund action regarding ManTech International Corporation (NASDAQ:MANT).

Hedge fund activity in ManTech International Corporation (NASDAQ:MANT)

At the end of the second quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MANT over the last 16 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ken Griffin’s Citadel Investment Group has the largest position in ManTech International Corporation (NASDAQ:MANT), worth close to $3.8 million, corresponding to less than 0.1%% of its total 13F portfolio. On Citadel Investment Group’s heels is Israel Englander of Millennium Management, with a $2.1 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers that are bullish comprise Murray Stahl’s Horizon Asset Management, John Overdeck and David Siegel’s Two Sigma Advisors and Hoon Kim’s Quantinno Capital.

Since ManTech International Corporation (NASDAQ:MANT) has witnessed bearish sentiment from hedge fund managers, we can see that there was a specific group of fund managers that slashed their entire stakes in the second quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the biggest position of the 750 funds followed by Insider Monkey, valued at about $1.5 million in stock, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital was right behind this move, as the fund cut about $0.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 1 funds in the second quarter.

Let’s check out hedge fund activity in other stocks similar to ManTech International Corporation (NASDAQ:MANT). These stocks are Cirrus Logic, Inc. (NASDAQ:CRUS), John Wiley & Sons Inc (NYSE:JW), Brandywine Realty Trust (NYSE:BDN), and National General Holdings Corp (NASDAQ:NGHC). This group of stocks’ market valuations are similar to MANT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRUS | 23 | 289863 | 6 |

| JW | 17 | 109505 | 0 |

| BDN | 14 | 92127 | -1 |

| NGHC | 18 | 225830 | 0 |

| Average | 18 | 179331 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $179 million. That figure was $11 million in MANT’s case. Cirrus Logic, Inc. (NASDAQ:CRUS) is the most popular stock in this table. On the other hand Brandywine Realty Trust (NYSE:BDN) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks ManTech International Corporation (NASDAQ:MANT) is even less popular than BDN. Hedge funds clearly dropped the ball on MANT as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on MANT as the stock returned 8.9% during the third quarter and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.