A market correction in the fourth quarter, spurred by a number of global macroeconomic concerns and rising interest rates ended up having a negative impact on the markets and many hedge funds as a result. The stocks of smaller companies were especially hard hit during this time as investors fled to investments seen as being safer. This is evident in the fact that the Russell 2000 ETF underperformed the S&P 500 ETF by nearly 7 percentage points during the fourth quarter. We also received indications that hedge funds were trimming their positions amid the market volatility and uncertainty, and given their greater inclination towards smaller cap stocks than other investors, it follows that a stronger sell-off occurred in those stocks. Let’s study the hedge fund sentiment to see how those concerns affected their ownership of Liberty Latin America Ltd. (NASDAQ:LILA) during the quarter.

Is Liberty Latin America Ltd. (NASDAQ:LILA) undervalued? Investors who are in the know are turning bullish. The number of long hedge fund bets inched up by 2 recently. Our calculations also showed that lila isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Warren Buffett of Berkshire Hathaway

Let’s review the key hedge fund action encompassing Liberty Latin America Ltd. (NASDAQ:LILA).

What have hedge funds been doing with Liberty Latin America Ltd. (NASDAQ:LILA)?

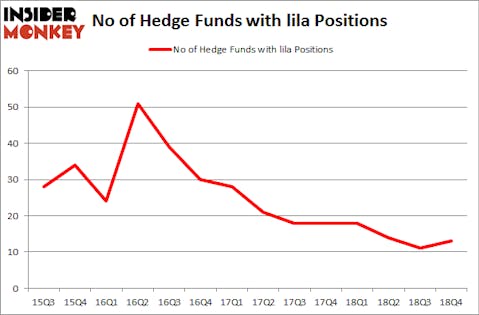

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in LILA over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, William Crowley, William Harker, and Stephen Blass’s Ashe Capital has the most valuable position in Liberty Latin America Ltd. (NASDAQ:LILA), worth close to $48.8 million, comprising 4% of its total 13F portfolio. Sitting at the No. 2 spot is Berkshire Hathaway, led by Warren Buffett, holding a $39.3 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that hold long positions contain Stephen J. Errico’s Locust Wood Capital Advisers, Paul Marshall and Ian Wace’s Marshall Wace LLP and Ryan Pedlow’s Two Creeks Capital Management.

Now, key hedge funds were breaking ground themselves. Locust Wood Capital Advisers, managed by Stephen J. Errico, assembled the most valuable position in Liberty Latin America Ltd. (NASDAQ:LILA). Locust Wood Capital Advisers had $11.6 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also initiated a $9.8 million position during the quarter. The other funds with brand new LILA positions are Israel Englander’s Millennium Management and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Liberty Latin America Ltd. (NASDAQ:LILA) but similarly valued. These stocks are Ardagh Group S.A. (NYSE:ARD), Chemical Financial Corporation (NASDAQ:CHFC), Silgan Holdings Inc. (NASDAQ:SLGN), and BancorpSouth Bank (NYSE:BXS). All of these stocks’ market caps resemble LILA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARD | 10 | 41540 | 2 |

| CHFC | 10 | 36182 | 2 |

| SLGN | 14 | 108007 | 2 |

| BXS | 9 | 54741 | 2 |

| Average | 10.75 | 60118 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $130 million in LILA’s case. Silgan Holdings Inc. (NASDAQ:SLGN) is the most popular stock in this table. On the other hand BancorpSouth Bank (NYSE:BXS) is the least popular one with only 9 bullish hedge fund positions. Liberty Latin America Ltd. (NASDAQ:LILA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on LILA as the stock returned 41.1% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.