Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

Is Insulet Corporation (NASDAQ:PODD) undervalued? Hedge funds are becoming less hopeful. The number of long hedge fund positions were trimmed by 2 recently. Our calculations also showed that PODD isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Matthew Hulsizer of PEAK6 Capital

We’re going to take a glance at the latest hedge fund action encompassing Insulet Corporation (NASDAQ:PODD).

How are hedge funds trading Insulet Corporation (NASDAQ:PODD)?

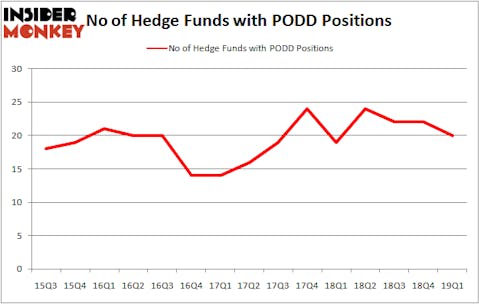

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards PODD over the last 15 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Insulet Corporation (NASDAQ:PODD) was held by D E Shaw, which reported holding $81.4 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $54.2 million position. Other investors bullish on the company included Think Investments, Millennium Management, and GLG Partners.

Judging by the fact that Insulet Corporation (NASDAQ:PODD) has witnessed bearish sentiment from the aggregate hedge fund industry, logic holds that there exists a select few hedge funds that slashed their full holdings heading into Q3. At the top of the heap, Daniel Sundheim’s D1 Capital Partners dumped the largest investment of the “upper crust” of funds monitored by Insider Monkey, valued at an estimated $132.9 million in stock. Jim Simons’s fund, Renaissance Technologies, also cut its stock, about $17.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest fell by 2 funds heading into Q3.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Insulet Corporation (NASDAQ:PODD) but similarly valued. We will take a look at Cable One Inc (NYSE:CABO), Affiliated Managers Group, Inc. (NYSE:AMG), Gardner Denver Holdings, Inc. (NYSE:GDI), and Coupa Software Incorporated (NASDAQ:COUP). This group of stocks’ market caps are similar to PODD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CABO | 18 | 524921 | 3 |

| AMG | 23 | 517004 | -4 |

| GDI | 23 | 386157 | -4 |

| COUP | 41 | 1385130 | 5 |

| Average | 26.25 | 703303 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 26.25 hedge funds with bullish positions and the average amount invested in these stocks was $703 million. That figure was $246 million in PODD’s case. Coupa Software Incorporated (NASDAQ:COUP) is the most popular stock in this table. On the other hand Cable One Inc (NYSE:CABO) is the least popular one with only 18 bullish hedge fund positions. Insulet Corporation (NASDAQ:PODD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on PODD as the stock returned 15.7% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.