Hedge funds run by legendary names like George Soros and David Tepper make billions of dollars a year for themselves and their super-rich accredited investors (you’ve got to have a minimum of $1 million liquid to invest in a hedge fund) by spending enormous resources on analyzing and uncovering data about small-cap stocks that the big brokerage houses don’t follow. Small caps are where they can generate significant outperformance. That’s why we pay special attention to hedge fund activity in these stocks.

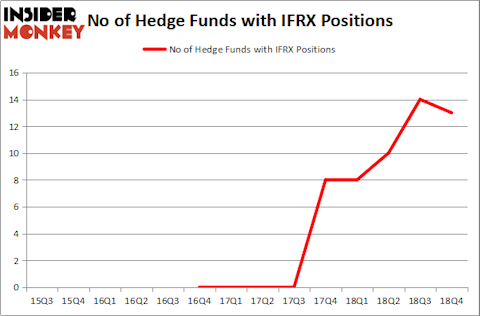

InflaRx N.V. (NASDAQ:IFRX) has seen a decrease in hedge fund interest in recent months. Our calculations also showed that IFRX isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the fresh hedge fund action encompassing InflaRx N.V. (NASDAQ:IFRX).

What does the smart money think about InflaRx N.V. (NASDAQ:IFRX)?

At the end of the fourth quarter, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -7% from the previous quarter. By comparison, 8 hedge funds held shares or bullish call options in IFRX a year ago. With the smart money’s sentiment swirling, there exists a select group of key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

The largest stake in InflaRx N.V. (NASDAQ:IFRX) was held by Adage Capital Management, which reported holding $97.5 million worth of stock at the end of December. It was followed by RA Capital Management with a $75.8 million position. Other investors bullish on the company included Redmile Group, Cormorant Asset Management, and Rock Springs Capital Management.

Judging by the fact that InflaRx N.V. (NASDAQ:IFRX) has experienced declining sentiment from the smart money, logic holds that there were a few funds that elected to cut their full holdings in the third quarter. Interestingly, Matt Sirovich and Jeremy Mindich’s Scopia Capital sold off the biggest position of the 700 funds monitored by Insider Monkey, comprising an estimated $7 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund cut about $0.7 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 1 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as InflaRx N.V. (NASDAQ:IFRX) but similarly valued. These stocks are Constellium NV (NYSE:CSTM), TrueCar, Inc. (NASDAQ:TRUE), Chase Corporation (NYSEAMEX:CCF), and Changyou.Com Ltd (NASDAQ:CYOU). This group of stocks’ market values resemble IFRX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSTM | 32 | 234205 | -3 |

| TRUE | 15 | 221328 | -3 |

| CCF | 5 | 75172 | -1 |

| CYOU | 7 | 49826 | 1 |

| Average | 14.75 | 145133 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.75 hedge funds with bullish positions and the average amount invested in these stocks was $145 million. That figure was $327 million in IFRX’s case. Constellium NV (NYSE:CSTM) is the most popular stock in this table. On the other hand Chase Corporation (NYSEAMEX:CCF) is the least popular one with only 5 bullish hedge fund positions. InflaRx N.V. (NASDAQ:IFRX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on IFRX as the stock returned 41% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.