Is Humana Inc (NYSE:HUM) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

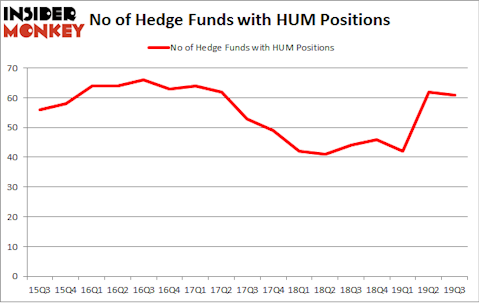

Humana Inc (NYSE:HUM) was in 61 hedge funds’ portfolios at the end of the third quarter of 2019. HUM shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. There were 62 hedge funds in our database with HUM holdings at the end of the previous quarter. Our calculations also showed that HUM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a large number of methods stock market investors have at their disposal to appraise their holdings. A duo of the most under-the-radar methods are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the elite money managers can outclass the market by a solid amount (see the details here).

Larry Robbins of Glenview Capital

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s take a look at the key hedge fund action encompassing Humana Inc (NYSE:HUM).

How are hedge funds trading Humana Inc (NYSE:HUM)?

Heading into the fourth quarter of 2019, a total of 61 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -2% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in HUM over the last 17 quarters. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were adding to their stakes substantially (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Humana Inc (NYSE:HUM), with a stake worth $755.8 million reported as of the end of September. Trailing Renaissance Technologies was Glenview Capital, which amassed a stake valued at $408.9 million. Lone Pine Capital, Two Sigma Advisors, and Maverick Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position TPG-AXON Management LP allocated the biggest weight to Humana Inc (NYSE:HUM), around 15.22% of its portfolio. Tavio Capital is also relatively very bullish on the stock, dishing out 8.36 percent of its 13F equity portfolio to HUM.

Because Humana Inc (NYSE:HUM) has experienced a decline in interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of funds that slashed their positions entirely heading into Q4. It’s worth mentioning that Christopher James’s Partner Fund Management dumped the largest investment of the “upper crust” of funds watched by Insider Monkey, totaling an estimated $149.1 million in stock, and Jeffrey Altman’s Owl Creek Asset Management was right behind this move, as the fund dumped about $74.6 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 1 funds heading into Q4.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Humana Inc (NYSE:HUM) but similarly valued. These stocks are Yum! Brands, Inc. (NYSE:YUM), Energy Transfer L.P. (NYSE:ET), The Kraft Heinz Company (NASDAQ:KHC), and NetEase, Inc (NASDAQ:NTES). All of these stocks’ market caps resemble HUM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YUM | 35 | 842106 | 5 |

| ET | 30 | 623109 | 1 |

| KHC | 36 | 9572927 | 2 |

| NTES | 30 | 3513002 | -4 |

| Average | 32.75 | 3637786 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $3638 million. That figure was $3527 million in HUM’s case. The Kraft Heinz Company (NASDAQ:KHC) is the most popular stock in this table. On the other hand Energy Transfer L.P. (NYSE:ET) is the least popular one with only 30 bullish hedge fund positions. Compared to these stocks Humana Inc (NYSE:HUM) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on HUM as the stock returned 33.5% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.