Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards FormFactor, Inc. (NASDAQ:FORM).

Hedge fund interest in FormFactor, Inc. (NASDAQ:FORM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare FORM to other stocks including BMC Stock Holdings, Inc. (NASDAQ:BMCH), CareDx, Inc. (NASDAQ:CDNA), and CNX Midstream Partners LP (NYSE:CNXM) to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the latest hedge fund action surrounding FormFactor, Inc. (NASDAQ:FORM).

What does the smart money think about FormFactor, Inc. (NASDAQ:FORM)?

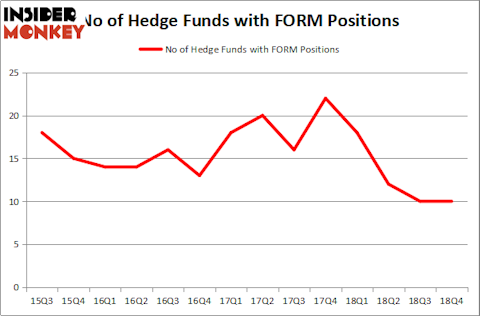

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 18 hedge funds with a bullish position in FORM a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the biggest position in FormFactor, Inc. (NASDAQ:FORM). Royce & Associates has a $20 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is Point72 Asset Management, managed by Steve Cohen, which holds a $13 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining peers that are bullish comprise Seymour Sy Kaufman and Michael Stark’s Crosslink Capital, Ken Fisher’s Fisher Asset Management and D. E. Shaw’s D E Shaw.

Due to the fact that FormFactor, Inc. (NASDAQ:FORM) has faced declining sentiment from the smart money, logic holds that there exists a select few money managers that decided to sell off their entire stakes by the end of the third quarter. Interestingly, Philippe Jabre’s Jabre Capital Partners said goodbye to the largest position of the 700 funds followed by Insider Monkey, comprising an estimated $0.4 million in stock, and John Overdeck and David Siegel’s Two Sigma Advisors was right behind this move, as the fund dropped about $0.3 million worth. These transactions are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to FormFactor, Inc. (NASDAQ:FORM). These stocks are BMC Stock Holdings, Inc. (NASDAQ:BMCH), CareDx, Inc. (NASDAQ:CDNA), CNX Midstream Partners LP (NYSE:CNXM), and Lindsay Corporation (NYSE:LNN). This group of stocks’ market values are similar to FORM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BMCH | 24 | 192261 | -1 |

| CDNA | 22 | 142197 | 3 |

| CNXM | 6 | 13468 | -3 |

| LNN | 11 | 214015 | 3 |

| Average | 15.75 | 140485 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $140 million. That figure was $48 million in FORM’s case. BMC Stock Holdings, Inc. (NASDAQ:BMCH) is the most popular stock in this table. On the other hand CNX Midstream Partners LP (NYSE:CNXM) is the least popular one with only 6 bullish hedge fund positions. FormFactor, Inc. (NASDAQ:FORM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on FORM as the stock returned 29.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.