It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. Since stock returns aren’t usually symmetrically distributed and index returns are more affected by a few outlier stocks (i.e. the FAANG stocks dominating and driving S&P 500 Index’s returns in recent years), more than 50% of the constituents of the Standard and Poor’s 500 Index underperform the benchmark. Hence, if you randomly pick a stock, there is more than 50% chance that you’d fail to beat the market. At the same time, the 20 most favored S&P 500 stocks by the hedge funds monitored by Insider Monkey generated an outperformance of more than 8 percentage points so far in 2019. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Endo International plc (NASDAQ:ENDP).

Endo International plc (NASDAQ:ENDP) has seen a decrease in support from the world’s most elite money managers lately. Our calculations also showed that ENDP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Bill Miller of Miller Value Partners

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to take a gander at the fresh hedge fund action regarding Endo International plc (NASDAQ:ENDP).

How have hedgies been trading Endo International plc (NASDAQ:ENDP)?

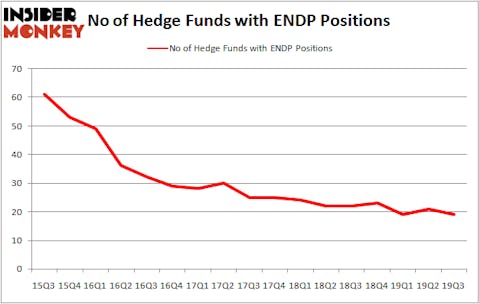

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a change of -10% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards ENDP over the last 17 quarters. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Glenview Capital held the most valuable stake in Endo International plc (NASDAQ:ENDP), which was worth $67.6 million at the end of the third quarter. On the second spot was Miller Value Partners which amassed $47.7 million worth of shares. Renaissance Technologies, Paulson & Co, and AQR Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Miller Value Partners allocated the biggest weight to Endo International plc (NASDAQ:ENDP), around 1.92% of its 13F portfolio. Chou Associates Management is also relatively very bullish on the stock, designating 0.74 percent of its 13F equity portfolio to ENDP.

Seeing as Endo International plc (NASDAQ:ENDP) has faced a decline in interest from the aggregate hedge fund industry, logic holds that there were a few money managers who were dropping their positions entirely heading into Q4. At the top of the heap, Samuel Isaly’s OrbiMed Advisors cut the biggest position of the 750 funds watched by Insider Monkey, totaling an estimated $25.4 million in stock. Ray Dalio’s fund, Bridgewater Associates, also said goodbye to its stock, about $13 million worth. These transactions are interesting, as total hedge fund interest dropped by 2 funds heading into Q4.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Endo International plc (NASDAQ:ENDP) but similarly valued. We will take a look at AdvanSix Inc. (NYSE:ASIX), Kimball International Inc (NASDAQ:KBAL), C&J Energy Services, Inc (NYSE:CJ), and Ready Capital Corporation (NYSE:RC). This group of stocks’ market values are closest to ENDP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASIX | 10 | 114711 | -5 |

| KBAL | 12 | 123697 | -1 |

| CJ | 18 | 116969 | -3 |

| RC | 4 | 40767 | -2 |

| Average | 11 | 99036 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $99 million. That figure was $209 million in ENDP’s case. C&J Energy Services, Inc (NYSE:CJ) is the most popular stock in this table. On the other hand Ready Capital Corporation (NYSE:RC) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Endo International plc (NASDAQ:ENDP) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Hedge funds were also right about betting on ENDP as the stock returned 58.3% during the first two months of Q4 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.