The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the fourth quarter, which unveil their equity positions as of December 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards DXP Enterprises Inc (NASDAQ:DXPE).

DXP Enterprises Inc (NASDAQ:DXPE) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Zumiez Inc. (NASDAQ:ZUMZ), Costamare Inc (NYSE:CMRE), and Epizyme Inc (NASDAQ:EPZM) to gather more data points.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to check out the latest hedge fund action regarding DXP Enterprises Inc (NASDAQ:DXPE).

How have hedgies been trading DXP Enterprises Inc (NASDAQ:DXPE)?

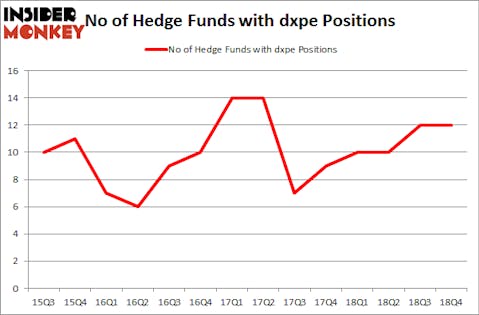

At Q4’s end, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards DXPE over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Nantahala Capital Management was the largest shareholder of DXP Enterprises Inc (NASDAQ:DXPE), with a stake worth $32 million reported as of the end of December. Trailing Nantahala Capital Management was Millennium Management, which amassed a stake valued at $3.7 million. AlphaOne Capital Partners, Renaissance Technologies, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: PDT Partners. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Tudor Investment Corp).

Let’s now review hedge fund activity in other stocks similar to DXP Enterprises Inc (NASDAQ:DXPE). These stocks are Zumiez Inc. (NASDAQ:ZUMZ), Costamare Inc (NYSE:CMRE), Epizyme Inc (NASDAQ:EPZM), and Hometrust Bancshares Inc (NASDAQ:HTBI). All of these stocks’ market caps are closest to DXPE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ZUMZ | 12 | 37840 | -5 |

| CMRE | 10 | 11291 | 2 |

| EPZM | 18 | 120880 | 3 |

| HTBI | 9 | 65265 | 0 |

| Average | 12.25 | 58819 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $59 million. That figure was $44 million in DXPE’s case. Epizyme Inc (NASDAQ:EPZM) is the most popular stock in this table. On the other hand Hometrust Bancshares Inc (NASDAQ:HTBI) is the least popular one with only 9 bullish hedge fund positions. DXP Enterprises Inc (NASDAQ:DXPE) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on DXPE as the stock returned 57.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.