Is Dorian LPG Ltd (NYSE:LPG) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

Is Dorian LPG Ltd (NYSE:LPG) a bargain? Investors who are in the know are taking an optimistic view. The number of long hedge fund positions increased by 2 recently. Our calculations also showed that lpg isn’t among the 30 most popular stocks among hedge funds.

At the moment there are several signals investors can use to assess stocks. A duo of the most under-the-radar signals are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the elite money managers can trounce their index-focused peers by a very impressive amount (see the details here).

Michael Lowenstein of Kensico Capital

Let’s analyze the recent hedge fund action regarding Dorian LPG Ltd (NYSE:LPG).

What have hedge funds been doing with Dorian LPG Ltd (NYSE:LPG)?

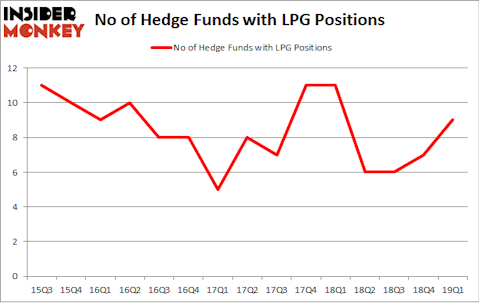

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, a change of 29% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LPG over the last 15 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

The largest stake in Dorian LPG Ltd (NYSE:LPG) was held by Kensico Capital, which reported holding $51.5 million worth of stock at the end of March. It was followed by Royce & Associates with a $15.8 million position. Other investors bullish on the company included GLG Partners, Citadel Investment Group, and Dalton Investments.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, established the biggest position in Dorian LPG Ltd (NYSE:LPG). Arrowstreet Capital had $0.5 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also initiated a $0.3 million position during the quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Dorian LPG Ltd (NYSE:LPG) but similarly valued. These stocks are Ferroglobe PLC (NASDAQ:GSM), Southern National Bancorp of Virginia, Inc (NASDAQ:SONA), Abeona Therapeutics Inc (NASDAQ:ABEO), and Miller Industries, Inc. (NYSE:MLR). This group of stocks’ market values are similar to LPG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GSM | 11 | 42976 | -3 |

| SONA | 8 | 19342 | 0 |

| ABEO | 15 | 69075 | 0 |

| MLR | 8 | 51292 | 0 |

| Average | 10.5 | 45671 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.5 hedge funds with bullish positions and the average amount invested in these stocks was $46 million. That figure was $71 million in LPG’s case. Abeona Therapeutics Inc (NASDAQ:ABEO) is the most popular stock in this table. On the other hand Southern National Bancorp of Virginia, Inc (NASDAQ:SONA) is the least popular one with only 8 bullish hedge fund positions. Dorian LPG Ltd (NYSE:LPG) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on LPG as the stock returned 42.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.