Hedge fund interest in Cytokinetics, Inc. (NASDAQ:CYTK) shares was flat at the end of last quarter and it wasn’t that high to begin with. This is usually a negative indicator. At the end of this article we will also compare CYTK to other stocks including The York Water Company (NASDAQ:YORW), Green Brick Partners Inc (NASDAQ:GRBK), and Heritage Insurance Holdings Inc (NYSE:HRTG) to get a better sense of its popularity.

In the financial world there are many metrics investors have at their disposal to evaluate publicly traded companies. Some of the most innovative metrics are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the best picks of the top hedge fund managers can outclass the S&P 500 by a superb margin (see the details here).

Nathan Fischel of DAFNA Capital

We’re going to take a look at the key hedge fund action regarding Cytokinetics, Inc. (NASDAQ:CYTK).

What have hedge funds been doing with Cytokinetics, Inc. (NASDAQ:CYTK)?

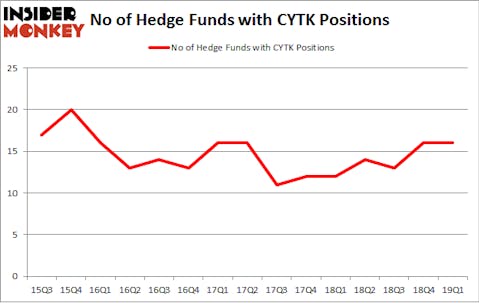

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. On the other hand, there were a total of 12 hedge funds with a bullish position in CYTK a year ago. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Biotechnology Value Fund / BVF Inc, managed by Mark Lampert, holds the largest position in Cytokinetics, Inc. (NASDAQ:CYTK). Biotechnology Value Fund / BVF Inc has a $30.8 million position in the stock, comprising 3.4% of its 13F portfolio. Coming in second is Alex Snow of Lansdowne Partners, with a $11.8 million position; 0.3% of its 13F portfolio is allocated to the company. Other professional money managers that hold long positions include Israel Englander’s Millennium Management, James A. Silverman’s Opaleye Management and Nathan Fischel’s DAFNA Capital Management.

Judging by the fact that Cytokinetics, Inc. (NASDAQ:CYTK) has experienced declining sentiment from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of fund managers who were dropping their positions entirely heading into Q3. Intriguingly, Jeffrey Jay and David Kroin’s Great Point Partners dropped the largest investment of all the hedgies tracked by Insider Monkey, worth an estimated $20.1 million in stock, and Noam Gottesman’s GLG Partners was right behind this move, as the fund dumped about $0.1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks similar to Cytokinetics, Inc. (NASDAQ:CYTK). These stocks are The York Water Company (NASDAQ:YORW), Green Brick Partners Inc (NASDAQ:GRBK), Heritage Insurance Holdings Inc (NYSE:HRTG), and Atlantic Capital Bancshares, Inc. (NASDAQ:ACBI). All of these stocks’ market caps match CYTK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YORW | 5 | 17100 | 0 |

| GRBK | 10 | 276439 | -4 |

| HRTG | 9 | 33157 | 3 |

| ACBI | 12 | 76229 | -2 |

| Average | 9 | 100731 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $101 million. That figure was $69 million in CYTK’s case. Atlantic Capital Bancshares, Inc. (NASDAQ:ACBI) is the most popular stock in this table. On the other hand The York Water Company (NASDAQ:YORW) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Cytokinetics, Inc. (NASDAQ:CYTK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on CYTK as the stock returned 37.7% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.